Irland

Debunking myths:

Why austerity and structural reforms have had little to do with Ireland’s economic recovery

Aidan Regan, European Politics and Policy/LSE, 2 February 2016

The Irish recovery has nothing to do with austerity induced cost competitiveness and everything to do with a State-led enterprise policy to attract foreign direct investment (FDI) from the United States.

The European Commission argues that the Irish recovery is an outcome of the government’s successful implementation of their structural adjustment programme

The problem with this old fashioned concept of competitiveness is that the firms driving Ireland’s export-led recovery are in high-wage price inelastic sectors (biotech, pharmaceuticals, finance, business and computer services). What this means is that their products are less sensitive to movements in international prices.

Top of page

The Economist 16 February 215

Traumatised by the way Lehman Brothers’ collapse almost brought down the financial system,

the European authorities concluded back then that every bank was systemically significant and none could be allowed to fail.

This led to the egregious /Outrageously bad; shocking/ mistake of making Irish taxpayers bail out German, French and UK investors

in private Irish banks

FT Editorial August 4, 2014

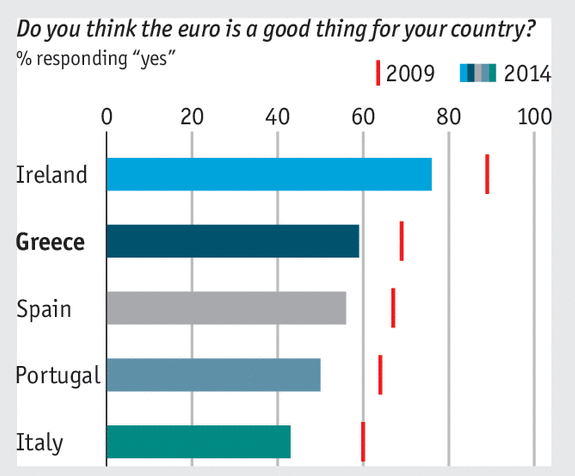

It is slow moving variables — long term unemployment, gradual shifts in public opinion, and so on — that pose the greatest threat to the Euro’s survival.

If the far right does as well as people now seem to think it will in the European elections,

this will presumably be presented in the media as a “shock” to the system,

but has it not been obvious since 2010 at the latest that something like this was likely, given Eurozone macroeconomic policies?

And has it not been obvious for years that actually existing EMU is harming the broader European project?

Kevin O Rourke, The Irish Economy, 25 February 2014

Europe’s political leaders should remember what Ernest Hemingway said about bankruptcy.

“How did you go bankrupt?"

Two ways. Gradually, then suddenly.”

"The Troika has done more damage to Ireland than Britain ever did in 800 years," said David Begg, head of the Irish Confederation of Trade Unions.

Mr Begg said the image of Ireland as the poster-child of EU recovery was a myth culitivated by EU creditors whose only interest is to recoup their money.

"At least the IMF officials are willing to admit they have been wrong but the EU officials are total ideologues."

"It is like being in an awful World War One conflict where the generals have expended a million lives to gain one yard of ground, yet nothing will change their mind in face of all the evidence."

Ambrose 28 Feb 2013

The outburst comes a day after Irish unions reached a provisional deal with the government for a further round of public sector pay cuts averaging 5.5pc, rising to 10pc for higher earners such as doctors. This follows 14pc pay cuts already in force.

Irish Finance minister Michael Noonan played down concerns about the slide in sterling against the euro, saying the Irish economy is now strong enough to withstand the exchange rate shock even though Britain accounts for a fifth of the country's exports.

"We don't see a problem for sterling at present levels. We have cut costs right through the economy with an internal devaluation of 15pc or 16pc and we are now highly competitive."

Ireland shows the way with its debt deal

Rescheduling of promissory notes is monetary financing in all but name

Wolfgang Münchau, FT February 10, 2013

Everybody seemed to be talking about monetary financing of debt last week – the ultimate taboo in monetary policy. And hidden behind a veil of unbelievable complexity, the eurozone may have done just that.

Various European central bankers rushed to proclaim that the agreed rescheduling of Ireland’s so-called promissory notes would not set a precedent for sovereign debt laundering.

In legal terms, the agreement is probably watertight. It may be a borderline issue, but who cares?

In economic terms, the situation is much clearer. This is monetary financing in all but name – and a jolly good thing it is too.

The interest rates will be lower, but this is not the real issue,

as the Irish economist Karl Whelan explained in what must be the best paper ever written on ELA and promissory notes.

Dublin hails ‘historic’ debt restructure

FT 7 February 7 2013

Draghi calls Schäuble a lawyer

At last week’s Ecofin, Schauble said, what he had reported before, that in his view, Cyprus was not systemically relevant

(which means that Germany could not legally participate in an ESM programme, as systemic relevance is a legal pre-condition under the German ESM law).

Draghi also warned that a default of Cyprus would also impede Ireland’s and Portugal’s return to the market

Eurointelligence 28 January 2013

EU:s finanspakt: Irland röstar men har inget val

Gunnar Jonsson, signerat, DN 31 maj 2012

RE: En lysande artikel

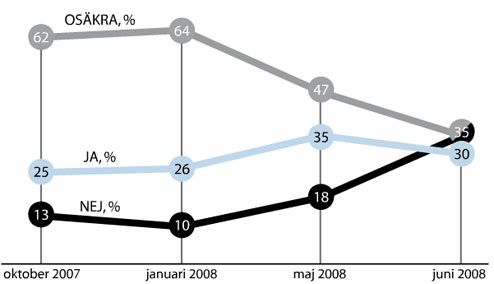

Opinionsundersökarna spår en klar seger för jasidan, men inte beror det på entusiasm. Medborgarna avskyr den rådande svångremspolitiken. Samtidigt är de rädda för att alternativet är utestängning från både Europas inre kretsar och de internationella kreditmarknaderna.

På 90-talet spann den keltiska tigern av belåtenhet. En avreglerad ekonomi med låg bolagsskatt lockade till sig multinationella företag och spred välstånd vida omkring.

Dess värre var euroräntan för låg för det överhettade Irland. Lönerna drog i väg.

Och mellan 1997 och 2007 fyrdubblades fastighetspriserna.

Den internationella finanskrisen spräckte bubblan, och efter Lehmankraschen 2008 kollapsade Irlands banker.

Farorna borde ha varit synliga i kristallkulan, även om alla som vanligt är klokast i efterhand.

Men nu begicks det avgörande misstaget: regeringen bestämde sig för att rädda bankerna genom en totalgaranti för alla deras kreditgivare.

Den kapsejsande finans- och fastighetssektorn välte rakt ned i skattebetalarnas knä

Paralleller finns med Spanien.

Före krisen var de offentliga finanserna i ordning, men allt rasade när staten skulle ta hand om det privata skuldberget. 2010 var Irlands budgetunderskott svindlande 32 procent.

Den sämsta banklösning Spanien kan låna är Irlands.

Paul Krugman, New York Times, 22 May 2011

men tänk om de goda tiderna beror på bostadsbubblan, som på Irland

Rolf Englund blog 23 november 2011

That was the fateful day on which the then Irish government extended its infamous guarantee to the banks, and thereby saddled the Irish taxpayer with liability for years of excessive, corrupt and injudicious lending.

Jeremy Warner, Daily Telegraph March 31st, 2011

to the tune of €440bn – some 250 per cent of Irish gross domestic product.

Everything that has happened in Ireland since then, especially its daily recurring banking crisis,

has been a consequence of that fateful decision.

FT Lex February 22 2011

The government’s humiliation is a historic moment for Ireland. For the first time, allegiances dating back to the civil war of the 1920s have been overshadowed by a newer trauma.

The wreckage from the banking crisis is stained with red ink, not with blood; it will nonetheless permanently change Irish society.

Financial Times editorial February 28 2011

Common monetary policy is the case in point. No correcting mechanism was put in place to take account of the fact that measures decided in Frankfurt could at times be too hot or too cold for the smaller economies.

So, what a country such as Ireland requires is clever and flexible use of fiscal policy to offset common monetary policy.

Yet the proposed fiscal compact will do the opposite. It will tie both policymaking hands behind our backs.

The popular delusion that the fiscal compact is a cure for our economic problems is a fantasy that needs demolishing.

Michael O’Sullivan, Financial Times 29 March 2012

Look and learn from across the Irish Sea

A generation ago it would have seemed ridiculous to go to Ireland for economics lessons. Not any more

George Osborne, nowadays Chancellor of the Exchequer, The Times February 23, 2006

Irland växte snabbt under 90-talet. Med euron tillkom en låg ränta som blåste upp en jättelik fastighetsbubbla.

Politiker, bankdirektörer och näringslivstoppar blundade och höll varandra om ryggen.

Även banker i andra euroländer lånade glatt till allt och alla.

Bubblan sprack slutligen 2008, och regeringen fick för sig att utfärda en totalgaranti för bankernas långivare.

När bankerna rasade gick botten ur statskassan.

Gunnar Jonsson, Signerat DN:s ledarsida 24/2 2011

Det är sant att Anders Borg har prioriterat ordning och reda i den offentliga ekonomin. Men det har han inte varit ensam om.

Samma sak kan även sägas om finansministrarna i Irland och Spanien, länder som till alldeles nyligen fick ett gott betyg för sin ekonomiska skötsel och hade föga gemensamt med exempelvis Grekland.

Peter Wolodarski, DN 20/2 2011

zc

men tänk om de goda tiderna beror på bostadsbubblan, som på Irland

Rolf Englund blog 23 november 2011

Mario Draghi said in a reply letter to Fianna Fail that "

considerable progress" has been made in mending Ireland's banks but more needs to be done to ensure the stability of the country's financial system, the Wall Street Journal reports. There is still a “very large stock” of non-performing loans, bank restructuring is yet to be completed and viability of the banking sector has to be ensured.

Moody's Investors Service said Friday that the "sheer scale" of the impaired loans on the books of Irish banks may lead the ECB to insist in the coming euro-area stress tests that Irish lenders set aside more loan-loss provisions than the Irish central bank has required so far.

Eurointelligence 25 March 2014

Den keltiska tigern väckte en gång beundran.

Men den låga räntan i valutaunionen ledde till överhettning, lönerna rusade, politiker och bankirer blev fartblinda.

Lehmankraschen spräckte den väldiga fastighetsbubblan och sänkte Irlands banker.

Här begicks ett grovt misstag när regeringen utfärdade en totalgaranti för alla deras kreditgivare.

DN-ledare signerad Gunnar Jonsson, 16 november 2013

Skattebetalarna tog smällen, och så ville EU-kommissionen och centralbanken ECB ha det på den tiden.

Nästa gång står aktieägare och obligationsinnehavare först i kön.

Sammanlagt har Irland fått 67,5 miljarder euro i nödlån. Sedan 2008 har dessutom skattehöjningar och nedskärningar värda 28 miljarder genomförts.

Åtstramningarna har varit brutala. Nästa år väntas dock tillväxt nära 2 procent. Konkurrenskraften är god och fastighetspriserna har vänt uppåt ur djupet.

Euroländerna grälar vidare om bankunionen.

Tyskland vill inte betala för någon kollektivisering av andras problem och håller fast vid att räddningsfonden ESM bara ska ge stöd till länder, inte direkt till banker.

Eurokrisen är inte över

DN-ledare signerad Gunnar Jonsson, 16 november 2013

Exemplet Irland visar faran. När en bankkrasch knäcker en liten statskassa sprider sig verkningarna, vad tyskarna än önskar.

Kvar på akuten finns dessutom Portugal och Cypern, samt givetvis Grekland vars räddning ingen kan garantera.

Eurokrisen är inte över.

The number of Irish homeowners not making their mortgage payments increased again in the first half of the year,

highlighting how Dublin faces significant challenges as it prepares to exit its international bailout programme later this year.

Stubbornly high unemployment and declining wages have prompted the arrears crisis.

A 50 per cent fall in Irish house prices since 2007 exacerbated the problem by

leaving hundreds of thousands of Irish borrowers trapped in negative equity.

Financial Times, August 23, 2013

Ireland has a good claim to being a model of adjustment through austerity and structural reform.

Yet success is far from assured

Charlemagne, The Economist print 12 January 2013

After suffering a catastrophic banking and property bust, it has met its deficit-cutting targets. It has recovered much of its export competitiveness. Multinational firms that use Ireland as a low-tax base are investing keenly once more. The Irish economy has been growing, albeit slowly, in contrast with the shrinking in the troubled periphery of the euro zone. And Ireland is regaining market confidence, this week selling €2.5 billion ($3.3 billion) worth of bonds at a lower interest rate than its bail-out loans.

Yet success is far from assured. The Irish economy is a strange hybrid: the front legs of its export sector may have recovered tigerlike strength, but the hind legs of the domestic economy are more akin to those of a sickly Mediterranean goat.

Both parts are vulnerable. As a big exporter Ireland is exposed both to recession in the rest of Europe and to a global slowdown. At home the burden of its collapsed banking sector is a heavy drag on the economy

(Ireland’s public debt shot up from 25% of GDP in 2007 to about 120% this year, and the budget deficit is still 8% of GDP).

Merkel has cast doubt on one of the main benefits of eurozone banking union only hours after the bloc’s leaders agreed to a slightly clearer time table for the creation of a single bank supervisor.

Ms Merkel said that bad assets held by Spanish and Irish banks will not be cleaned up by the eurozone’s new €500bn rescue fund, adding that it should only be used to shore up teetering financial institutions in the future.

Financial Times 19 October 2012

The debate over whether the U.S.’s largest banks are too big is heating up.

Since the 2008 financial crisis, the perception has taken hold among some analysts and economists that certain U.S. institutions are too big to fail, meaning they would have to be bailed out to protect the financial system in the event of another calamity.

The continued downward spiral in Europe raises a similar question: Are some banks too big to save, meaning their collapse could dramatically worsen the euro crisis

(as happened in Ireland in the fall of 2008 and is happening now in Spain and Greece)?

Simon Johnson, who served as chief economist at the IMF in 2007 and 2008, Bloomberg 3 September 2012

Måste Spanien upprepa Irlands misstag?

I Irland fick oron till följd att regeringen införde en bankgaranti.

När Irlands banker fick problem med hotande bankrusning fanns ingen "lender of last resort".

Hur kunde eurons konstruktörer glömma att förse valutaunionen med en fungerande centralbank

Danne Nordling 2 juni 2012

The fiscal treaty will not solve Europe’s crisis

The Spanish and Irish crises stem from too much cross-border private sector borrowing and lending

Today’s large fiscal deficits are a result of, not the cause of, Ireland’s and Spain’s crises.

David McWilliams, Financial Times 28 May 2012

Economists And Post-Crisis Policy (Also Ireland)

Henry Farrell and John Quiggin have posted their fascinating paper on the rise and

temporary, I think) fall of Keynesian economics in the aftermath of the financial crisis

Paul Krugman, March 11, 2012

Why do I think it’s temporary? Because the austerians have gone from disaster to disaster.

Just for fun, look at Alan Reynolds proclaiming the triumph of austerity in Ireland in the summer of 2010, and Tyler Cowen doing it again last fall.

Irish EU treaty vote threatens chaos

Ireland has shocked Europe with plans for a referendum on the EU's fiscal treaty,

a move that risks an unprecedented fragmentation of the eurozone and a major clash with Germany.

"It gives the Irish people the opportunity to reaffirm Ireland's commitment to membership of the euro,"

/the PM/ told ashen-faced members of the Dail.

Ambrose Evans-Pritchard, 28 February 2012

The Irish voted "No" to both the Nice and Lisbon treaties before being made to vote again. Dublin has ruled out a second vote this time.

Mrs Merkel's coalition base is in revolt over demands from Brussels and the International Monetary Fund for a boost in the EU rescue machinery (ESM) to €750bn (£635bn), the unspoken condition imposed by the rest of the world for unlocking global aid.

The new requests would push the German share of the funding to well over €300bn, breaching a €211bn ceiling set by the Bundestag in September.

Ireland will continue to receive loans under its €67bn package from the EU-ECB-IMF "Troika" even if it votes "No" but would be in serious trouble if it needed a second package later. The fiscal compact forbids to use of the ESM bail-out fund for non-signatories.

Ireland is getting a choice - which is more than other eurozone states

Democracy continues to interfere with the European Union's best laid plans.

It's bad enough that Greek elections could be held in April to allow voters there the chance

to express a view on new rules and regulations being imposed on them

Damian Reece, 28 Feb 2012

Citizens of Ireland will be asked to vote on Europe's fiscal treaty, which imposes new rules on their government's ability to control its own tax and spending, among other things.

The loss of sovereignty this implies is unpopular there, to say the least.

Irland ska hålla en folkomröstning om den nya europakten om budgetdisciplin

Det var definitivt inte vad Tysklands förbundskansler Angela Merkel ville höra

Irländarna kan mycket väl tänkas rösta nej igen.

Då får de väl, som traditionen och Tyskland bjuder, helt enkelt rösta om.

DN-ledare, signerad Gunnar Jonsson, 29 februari 2012

Den gröna ön hamnade på obestånd när finanskrisen spräckte bankbubblan, men Irland är inte emot budgetbalansering som sådan. Grundlagen påbjuder dock folkomröstning när makt ska flyttas till EU.

Både 2001 och 2008 sa irländarna nej till EU-fördrag, för att sedan ändra sig.

Ireland will hold a referendum on the eurozone fiscal treaty,

plunging Europe into months of uncertainty and potentially

placing a question mark over Ireland’s future membership of the euro

Financial Times, 28 February 2012

Under the Irish constitution, the Irish people have to vote to ratify any significant transfer of sovereignty to Europe. Dublin has held referendums on every significant EU treaty since 1987 when Raymond Crotty, an economics professor, won a landmark legal challenge against the state, forcing a plebiscite on the Single European Act.

Det välskötta Irland klarar krisen,

men kostnaden för euroäventyret är gigantisk

Nils Lundgren 15 februari 2012

Euron störtade Irland i kris därför att den privata sektorn, framför allt bygg- och fastighetsbranschen, lånade allt vad tygen höll till de låga räntor som ECB måste hålla för att det passade den jättelika tyska ekonomin.

Eftersom Irland inte kunde föra en egen penningpolitik anpassad för att klara den framväxande lånebubblan, slutade det hela med en enorm bankkrasch, när det stod klart att lånen inte kunde betalas tillbaka.

Banksystemet fick räddas av de irländska skattebetalarna till en kostnad som bara under året 2010 kostade 30 procent av BNP.

Fiscal irresponsibility; Greece, but nobody else.

Italy ran deficits in the years before the crisis, but they were only slightly larger than Germany’s

(Italy’s large debt is a legacy from irresponsible policies many years ago).

Portugal’s deficits were significantly smaller, while Spain and Ireland actually ran surpluses

Paul Krugman, New York Times, February 26, 2012

Recent events have given us a dramatic demonstration of

the reality of nominal wage stickiness.

Despite crushing unemployment, wages in Ireland and Latvia have come down only slightly

— but Iceland, by letting its currency devalue, achieved a quick 30 percent fall in wages relative to the euro zone.

Paul Krugman. December 24, 2011

Interndevalvering via Ådalsmetoden

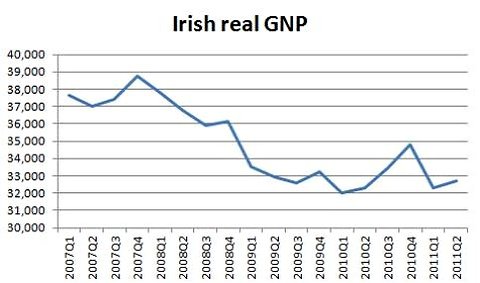

No. The Irish Economy Is Not Recovering

via Brad deLong, 15 December

Ett år efter Irland fick sitt räddningspaket är läget fortfarande mycket mörkt.

Konsumtionen faller, investeringarna likaså, och folket är förbannade för att

nästa års budget mejlats runt i Tyskland innan det irländska parlamentet fått se den.

Enligt ekonomer kan ytterligare nödlån från EU behövas.

SvD nyhetsplats 29 november 2011

Real income, which bottomed out 18.4% below the previous peak, is now only 15.7% below that peak …

Paul Krugman, NYT 30 Sept 2011

I really wonder about the state of economics education.

Paul Krugman on Ireland

New Yourk Times 23 Sept 2011

The European Union’s Maastricht treaty was designed to deal only with imbalances in the public sector; but excesses in the banking sector have been far worse.

George Soros, FT August 14, 2011

The euro’s introduction led to housing booms in countries such as Spain and Ireland.

Eurozone banks became among the world’s most over-leveraged, and they remain in need of protection from counterparty risks.

Moody’s cuts Ireland to junk

The more politicians talk about private-sector participation for Greece,

the greater the risk of a downgrade for Ireland and Portugal.

Eurointelligence 13 July 2011

Sverige, Irland och deras Tiger-ekonomier och bostadsbubblor

Rolf Englund blog 11 juli 2011

The Irish finance minister, Michael Noonan, said that 30 September, 2008, will go down in history as the blackest day in Ireland since the Civil War.

That was the fateful day on which the then Irish government extended its infamous guarantee to the banks, and thereby saddled the Irish taxpayer with liability for years of excessive, corrupt and injudicious lending.

Jeremy Warner, Daily Telegraph March 31st, 2011

Irish negotiators were hoping to be able to announce with the recapitalisation that this ECB funding had been converted into some kind of medium term facility to allow the banks time to deleverage or find alternative deposits.

But there’s been unexplained silence on this front so far. The ECB seems to be struggling to agree mutually acceptable terms.

Euroländerna har enats om en plan för statlig bankgaranti

Veckans Affärer 2008-10-12

FI positiv till förslag om statlig bankgaranti

FI pekar dock på risken att explicita eller implicita statliga garantier kan ge upphov till icke önskvärda beteenden hos bankerna.

Pressmeddelande 2008-10-27

Alla banker har lämnat det statliga garantiprogrammet, meddelar Riksgälden.

Vid halvårsskiftet uppgick de utestående garantierna till 196 miljarder kronor. Vid årsskiftet var motsvarande siffra 271 miljarder kronor.

Som allra mest uppgick garantierna till 354 miljarder kronor.

Swedbank har tecknat nära 90 procent av garantierna

SvD Näringsliv/TT 10 augusti 2010

I find it unforgivable that the last Irish government guaranteed bank debt so insouciantly and that the rest of the European Union has supported this decision.

For a sovereign to destroy its own credit, to save creditors of its banks, is plainly wrong.

It does not make it better, but worse, that it is doing so largely to protect financial systems in other countries.

Martin Wolf, FT March 8 2011

Italy turmoil shows banking ‘doom loop’ still a powerful force

FT 5 June 2018

Måste Spanien upprepa Irlands misstag?

I Irland fick oron till följd att regeringen införde en bankgaranti.

När Irlands banker fick problem med hotande bankrusning fanns ingen "lender of last resort".

Hur kunde eurons konstruktörer glömma att förse valutaunionen med en fungerande centralbank

Danne Nordling 2 juni 2012

RE; Förra gången Sverige införde statlig bankgaranti

Enligt vår uppfattning stod det finansiella systemet i Sverige inför en kollaps den 24 september 1992.

Utländska långivare hade tappat förtroendet för det svenska banksystemet.

Bedömningen var att utan ett omfattande statligt ingripande hade vi stått inför en finansiell härdsmälta av aldrig tidigare skådat slag. Utan åtgärder kunde även i slutändan statens upplåning komma att påverkas.

Nationens hela finansiella funktionsförmåga stod på spel.

Stefan Ingves och Göran Lind, Ekonomisk Debatt nr 1/1998

Jag var statsminister under dessa år och fast övertygad om fördelarna med en hårdvalutapolitik. Det hade delvis att göra med de tidigare decenniernas erfarenhet av devalveringspolitik, men var

delvis en konsekvens av att jag strävade efter att Sverige skulle gå in i det europeiska samarbetets kärna, också den ekonomiska och monetära unionen, och därmed vara med i den gemensamma europeiska valutan från dess första dag.

Försvaret av kronan handlade om den viktiga kombinationen av ekonomisk politik och Europapolitik.

Carl Bildts veckobrev v1/2002

The banks are being forced to shrink to a size that poses less risk to the Irish economy.

They've been instructed to reduce the net loans on their balance sheets by 71bn euros by the end of 2013

- an amount equivalent to around half the value of the Irish economy.

Robert Peston, the BBC's business editor, 31 March 2011

And this process, known as deleveraging, is expected to generate another £11bn (12bn euros) of losses for the quartet of Irish banks, as certain loans and assets are bound to be sold or unwound for less than their face value.

Could the Irish banking system, where a single nationalised bank, Anglo Irish, has just announced losses of £16bn (18bn euros), equivalent to well over a third of all revenues received by the Irish government, be any more bust (and thanks to the journalist Fintan O'Toole for that comparator)?

Irish banks need extra 24bn euros to survive

Until now, losses in the Irish banking system have stemmed from the collapse of a speculative bubble in the commercial property sector, where billions were borrowed from the banks to fund hotels and shopping malls.

However, the latest stress tests focused instead on an emerging meltdown in the residential sector.

BBC 31/3 2011

The total total amount poured into the Irish banks since the financial crisis is close to 70bn euros.

That is equivalent to almost half of the Irish economy's annual output, or about 17,000 euros per Irish citizen - a burden that the government sees as unacceptable.

Full textThe unbelievable truth about Ireland and its banks

Total quantity of state investment a breathtaking 75bn euros - 45% of GDP

Robert Peston, the BBC's business editor, 30 March 2011

Regulators at the Irish central bank have conducted a review of how much extra capital - as a buffer against future losses - is required by Bank of Ireland, Allied Irish Bank, EBS and Irish Life and Permanent.

Unless something unexpected happens in the next 24 hours, the total amount of additional capital that will need to be injected into these banks will be a bit less than 35bn euros - including 8bn euros that was supposed to be injected into them at the end of February, but was postponed because of Ireland's political turmoil.

That would take the total quantity of state investment in Ireland banks to a breathtaking 75bn euros (actually a tiny bit more than that).

That is an almost unbelievably large number. When I think about it, I have a small panic attack - because it represents 45% of Ireland's GDP and 55% of its GNP.

The European Central Bank turned a blind eye to "irresponsible lending" by German, French, British and Belgian banks,

the European Union's former ambassador to the United States, John Bruton has said.

EUobserver 8/3 2011

In a damning speech at the London School of Economics on Monday (7 March) evening, Mr Bruton, also a former Irish prime minister of the same conservative political stripe as the current leader-elect, Enda Kenny, has accused Frankfurt of failing to use its powers to rein in speculative bubbles in countries such as Ireland and Spain.

"From 2000 on, British, German, Belgian, French banks, and banks of other EU countries lent irresponsibly to the Irish banks in the hope that they too could profit from the then obtaining Irish construction bubble," he said. "They were supervised by their home central banks, and by the ECB ... who seemingly raised no objection to this lending."

Moody’s cut the ratings of Irish banks to junk status

The downgrade means the unguaranteed unsecured senior bonds at Ireland’s six banks are now rated as non-investment grade, or junk.

FT, February 11 2011

Spain’s success is of acute relevance to the rest of the eurozone

Spain is where Ireland was a couple of years ago

Mohamed El-Erian, FT February 3 2011

Anyone familiar with the Byzantine complexities of European policymaking would not have been surprised to learn that

the latest round of EU bank stress testing is going to be – well, about as testing as the last one,

which famously found both Allied Irish Banks and Bank of Ireland to be perfectly solvent.

Jeremy Warner Daily Telegraph 9 March 2011

"Irish domestic banks currently depend almost entirely on the (European Central Bank) to refinance expiring market debt,"

Total debts of the six Irish banks approach USD 375 billion, more than 170 percent of Ireland's gross domestic product.

S&P senior analyst Frank Gill, CNBC, 2 Feb 2011

“Amazing” that the Irish government has “socialized” the banks

— some $80 billion in senior and subordinated debt — and made it the financial responsibility of Irish taxpayers, who didn’t create it.

Michael Lewis, author of "Liar’s Poker," "The Big Short" and "The Blind Side,"

CNBC 1 Feb 2011

The IMF’s Article IV report on Ireland published in September 2007 begins:

“Economic performance remains very strong, supported by SOUND policies. Given the Irish economy’s strong fundamentals and the authorities’ commitment to sound policies, Directors expected economic growth to remain robust over the medium term.”

The IMF said Ireland was in fiscal SURPLUS of 3pc of GDP and total public debt had fallen to just 12pc.

Ambrose Evans-Pritchard January 21st, 2011

Ireland had almost entirely eliminated its public debt.

Mr Barroso’s own staff signed off happily on Ireland’s accounts in their Stability Update report December 2007, discerning risks but agreeing that the country was “operating responsible fiscal policy”.

For Mr Barroso to talk now about Ireland’s ” fiscally irresponsible situation” is to rewrite history.

Irland

net outward migration to be 100,000 over the two-year period from April 2010 to April 2012.

CNBC 20/1 2011

An unprecedented financial crisis has forced Irish people, particularly young graduates, to once again seek opportunities overseas, echoing previous generations of departures and making emigration a hot topic in an upcoming parliamentary election.

The Economic andSocial Research Institute (ESRI) has estimated net outward migration to be 100,000 over the two-year period from April 2010 to April 2012.

The rate of departure is the highest in recent memory and overshadows even the 1980s, a decade scarred by emigration, when the net outflow peaked at 44,000 in 1989.

*

Ingen kan idag säga när Europa har fått en sådan geografisk rörlighet, en så stor federal budget och en sådan nominell löneflexibilitet att en gemensam valuta kan fungera från Sicilien till Nordkap.

Medan vi väntar på den dagen, bör vi dock ställa oss frågan, om vi vill underminera nationernas möjligheter till överlevnad som nationer i sådan omfattning, som krävs, när vinsten av en gemensam valuta enligt de studier som gjorts är så utomordentligt blygsam?

Ty en nation överlever knappast i längden som nation, om den inte kan erbjuda de egna medborgarna en inhemsk differentierad arbetsmarknad med det moderna samhällets alla kvalificerade arbetsuppgifter.

En egen valuta kan vara ett nödvändigt, ehuru naturligtvis inte tillräckligt, villkor för nationens möjligheter som nation under många årtionden framåt. Påståendet kan inte bevisas, men inte heller motbevisas och vi bör tänka efter vilka risker vi är beredda att ta.

Nils Lundgren 1994

Joschka Fischer om en ny allians mellan Paris och Berlin

Den irländska krisen har kommit mig att för första gången undra om euron – och därmed EU – kan gå i stöpet.

Trenden går i riktning mot ett ”tyskt Europa”, som aldrig kommer att fungera.

Joschka Fischer, Kolumn DN 28/12 2010

If Germany and its hard-money allies genuinely wish to save the euro – which is open to doubt –

they should stop posturing, face up to the grim imperative of a Transferunion, and

desist immediately from imposing their ruinous and reactionary policies of debt deflation on southern Europe and Ireland.

Ambrose Evans-Pritchard, 19 Dec 2010

Look and learn from across the Irish Sea

A generation ago it would have seemed ridiculous to go to Ireland for economics lessons. Not any more

A generation ago, the very idea that a British politician would go to Ireland to see how to run an economy would have been laughable. The Irish Republic was seen as Britain’s poor and troubled country cousin, a rural backwater on the edge of Europe.

Today things are different. Ireland stands as a shining example of the art of the possible in long-term economic policymaking, and that is why I am in Dublin: to listen and to learn.

George Osborne, Chancellor of the Exchequer, The Times February 23, 2006

Ireland: An extreme version of the British disease

Robert Peston, BBC 22 November 2010

ECB Expresses `Serious Concerns' About Irish Proposals to Stabilize Banks

Bloomberg 20/12 2010

Ireland

Severe Budget cutbacks will see drop in living standards

Middle-income workers, families and social welfare recipients will bear the brunt of a €6 billion fiscal adjustmeny

Irish Times, December 7, 2010

The budget documents are now online.

The server is clearly busy but I just downloaded all the documents.

Karl Whelan, December 7th, 2010

The EU Is Pushing Ireland to the Brink of Ruin

To make sure that the state does not drown in its debts,

the annual rate of growth has to be significantly higher than the interest due on the national debt,

If the Irish economy does not grow by 8-10 percent, then the country will end in a debt-deflationary spiral.

And even the most optimistic government projections are just below 4 percent.

Der Spiegel 8/12 2010

And the austerity measures will achieve little if Ireland does not get a handle on the problems with its banking sector. It is still the country's Achilles' heel.

Ever since the Irish government's fatal decision to provide a blanket guarantee for all debts and deposits at the banks, the fate of the state has been linked to that to the financial institutions.

And those toxic debts left over from the real estate boom are still lurking in their accounts.

Irlands nedskärningar motsvarar 110 miljarder kronor

Rolf Englund blog 7/12 2010

In the spring of 2010, fiscal austerity became fashionable.

I use the term advisedly: the sudden consensus among Very Serious People that everyone must balance budgets now now now wasn’t based on any kind of careful analysis.

It was more like a fad, something everyone professed to believe because that was what the in-crowd was saying.

Paul Krugman, NYT October 21, 2010

Sverige bekräftar nu sin plats bland tigerekonomierna.

Under fjärde kvartalet 2010 växte Sveriges bruttonationalprodukt (BNP) med 7,3 procent och tillväxten för hela fjolåret blev 5,5 procent, den högsta siffran sedan 1970.

e24 2011-03-01

Ireland Central Bank governor Patrick Honohan warned repeatedly that the credit bubble was out of control and would end badly

Ambrose Evans-Pritchard 19 Nov 2010

It pains me to say this. I’m probably the most pro-euro economist on my side of the Atlantic.

I’m also a believer in the larger European project.

But given this abject failure of European and German leadership, I am going to have to rethink my position.

Barry Eichengreen

The markets attention shifted from the immediate funding problems to the underlying solvency issues.

Ireland’s interest rates under the EFSF will average 5.8%, and investors realised that this rate is too high to be sustainable.

As the country’s nominal growth is almost certain to lie well below that number for many years to come, Ireland’s debt will be on an explosive trajectory.

The markets have come to recognise that Ireland is insolvent. This morning, the yields on 10 years were close to 9.5% - which entails a high default probability.

Eurointelligence 30/11 2010

Here's what we Eurosceptics were saying about Ireland and the euro in 1998

Daniel Hannan November 21st, 2010

If the ECB determined monetary policy to suit the majority of participants, it would give “the peripheral states a double-dose of what they don’t need: low interest rates”. The consequence would be an unsustainable credit boom in some of those states and, in due course, a commensurately painful crash. The UK, we cautioned, should pay particular attention to what happened in Ireland: The UK and Ireland would be especially badly affected by monetary union with the Continent.

It would be nice if the BBC stopped trotting these characters /EMU-suportes/ out as if they were disinterested experts, while presenting those of us who opposed the euro as Right-wing eccentrics.

We don’t want an apology, those of us who got the call right: we just want to be listened to next time.

Daniel Hannan November 21st, 2010

Daniel Hannan is a writer and journalist, and has been Conservative MEP for South East England since 1999. He speaks French and Spanish and loves Europe, but believes that the European Union is making its constituent nations poorer, less democratic and less free.

Det var inte folket som besegrade eliten.

Det var den slutna ekonomins särintresse som besegrade den öppnas

Lars Jonung kolumn DNs ledarsida 10/9 2004

Nejsidan fann sitt starkaste stöd hos låginkomsttagare, anställda i stat och kommun, lågutbildade, LO-medlemmar, kvinnor och på landsbygden.

Ja-väljarna fanns främst bland höginkomsttagare, privatanställda, högutbildade, egenföretagare, Saco-medlemmar, män och i städerna.

Det finns jätterisker att det inte fungerar.

Att Irland kommer att misslyckas att få till sin ekonomi i alla fall – att de kommer att gå i statsbankrutt

och vara tvungna att be om att få sina skulder nedskrivna.

Om det händer har privata skulder i banker och finansbolag flyttas över till skattebetalarna.

Ekots Staffan Sonning 22/11 2010

Cui bono? The banks, of course.

I Sverige har bostadspriserna rusat i höjden med hela 116 procent på tio år.

Det är lika mycket som i Spanien och betydligt mer än på krisdrabbade Irland

där priserna stigit med 34 procent sedan år 2000, enligt SEB.

Expressen 24/11 2010

Back in 2007, Ireland’s net public debt was just 12 per cent of gross domestic product.

This compares with 50 per cent in Germany and 80 per cent in Greece.

Martin Wolf, FT November 23 2010

Spain, too, had net public debt in 2007 at just 27 per cent of GDP.

If the fiscal rules had been applied as ruthlessly as German policymakers say they now want (though their predecessors resisted their application to themselves in the early 2000s), they would have affected France and Germany more than twice as often as Ireland or Spain between inception of the eurozone and the current wave of crises.

It was not the public but the private sector that went haywire in Ireland and in Spain. In the low interest rate environment caused principally by chronically weak demand in core European countries – Germany’s real domestic demand was a mere 5 per cent higher in 2008 than in 1999 – asset prices and credit exploded in several peripheral countries, particularly Ireland.

The public-sector rescue of Ireland's banks is predicated on the idea that the banks' creditors will be reassured

by a lifting in their capital resources from 8% of assets to 12%.

Robert Peston BBC 29 November 2010

The fact is that a 12% "core tier 1 capital" ratio - while it may be a multiple of the protection that was in place for banks three years ago - will be seen as still too low by some investors and many international regulators

Ireland: An extreme version of the British disease

Robert Peston, BBC 22 November 2010

1) Banks that became too big and too dependent on overseas borrowing

2) Banks that lent far too much to commercial and residential property, fuelling an unsustainable boom that has gone pop

*

Irland gick in i den finansiella och ekonomiska krisen utan underskott och med närmast exemplariskt skötta statsfinanser.

Kanske är vi i Sverige blinda för att vi befinner oss i en irländsk/spansk situation med lånefest och, än så länge, stigande bostadspriser.

Rolf Englund blog 21/11 2010

The Irish bailout is not, after all, what one normally thinks of as a bailout

— it’s not like the Texas S&L bailout, where national taxpayers assumed the losses of failed Texas banks.

It’s simply an agreement to lend Ireland funds at more or less safe market rates.

We can also see why the bailout isn’t likely to succeed. The basic situation is that given the cost of rescuing Ireland’s banks

and the damage harsh austerity is inflicting on Ireland’s economy,

investors are understandably skeptical that the Irish government will actually be able to meet its commitments.

Paul Krugman New York Times November 23, 2010

De som försöker skuldbelägga Europeiska centralbankens låga ränta för den ohållbara låneexpansionen har en poäng.

Skeptiker till euron vädrar morgonluft och upprepar sin gamla kritik mot den gemensamma valutan:

– Vad var det vi sa, säger de. Euron passade inte för Greklands behov och den passar inte heller för Irlands.

Vad som krävs är en nationell räntepolitik och nationella valutor, som går att devalvera.

Peter Wolodarski, DN Signerat 21/11 2010

---

Peter Wolodarski försvarar EMU om Irland och Grekland

Rolf Englund blog 2010-11-21

Var det den gemensamma valutan som ligger bakom Irlands problem.

Skulle krisen ha dämpats om den irländska riksbanken hade kunnat höja räntan för att kyla av den keltiska tigern? Har landet drabbats av en så kallad asymmetrisk chock?

Ja, svarade Lars Calmfors. Han anser att Irland är ett tydligt exempel på att den gemensamma räntenivån i hela euroområdet kan skapa problem för enskilda länder.

Annika Ström Melin, DN Signerat 18/11 2010

Till skillnad från till exempel Grekland gick nämligen Irland in i den finansiella och ekonomiska krisen utan underskott och med närmast exemplariskt skötta statsfinanser.

Irland skulle, enligt Lars Calmfors, ha behövt en högre ränta – eller en stramare finanspolitik. Därför anser han att den irländska krisen visar att begreppet asymmetrisk chock inte är en teoretisk konstruktion, utan en högst praktisk verklighet.

Harry Flam höll inte med.

Poängen i den här artikeln är inte att döma vem av professorerna som har rätt. Men hur man än definierar en asymmetrisk chock finns ett politiskt ansvar för krisen som kan och bör utkrävas. Det räcker med att tänka på Storbritannien för att inse att det är för enkelt att skylla på euron.

Full textThe eurozone is pressing ahead with the same approach it has followed ever since the collapse of Lehmans

When in doubt, sign another blank cheque to private creditors, and try not to think about the money, or the moral hazard.

Stephanie Flanders, the BBC's economics editor, 22 November 2010

At the start of this year (Thinking the Unthinkable), I considered whether what the world needs now is not just a mechanism to allow banks to fail in the future, but to allow sovereign governments to fail as well. Chancellor Merkel may be right to want to find one, but right now the eurozone looks weaker, not stronger, for her efforts. We don't have a reasonable way to talk about restructuring any senior debt at all.

The two largest creditors to Ireland are /banks in/ the UK and Germany,

with loans outstanding of $149bn and $139bn respectively

An Irish bank default would affect the German and British banking systems directly, and require significant domestic bank bail-outs.

Wolfgang Münchau, FT November 21 2010

Cui bono? The banks, of course.

It was an old-fashioned property bubble

Ireland Central Bank governor Patrick Honohan warned repeatedly that the credit bubble was out of control and would end badly

Ambrose Evans-Pritchard 19 Nov 2010

Highly recommended

Dr Honohan was the towering prophet who foresaw the Celtic Calamity. A former official at both the World Bank and the IMF, he warned repeatedly from his perch at Trinity College Dublin that the credit bubble was out of control and would end badly.

His paper written for the World Bank in early 2009 entitled What Went Wrong In Ireland? recounts a catalogue of errors by Fianna Fail over the years and the pitfalls of euro membership, and is perhaps the best primer as to why the country is now under de facto tutelage of the EU and the IMF.

"It was an old-fashioned property bubble. Lengthy success lulled policy makers into a false sense of security. Captured by hubris, they neglected to ensure the basics, allowing a rogue bank's [Anglo Irish] reckless expansionism," he wrote.

Officials disclosed that the Irish central bank had extended €20bn ($27bn) of exceptional liquidity to the banks in September and October

– over and above the €130bn they had been lent by the European Central Bank,

which itself was one-quarter of all ECB lending to eurozone banks.

Financial Times November 19 2010

Bond markets sensed this extra aid meant one or two Irish banks might be close to using up all the assets they could put up to tap ECB liquidity.

It is not an exaggeration to say that there would not be a banking system in Ireland - and therefore not an economy in any conventional sense

- if it weren't for the generosity of the European Central Bank in providing loans to Irish banks

that the markets won't provide.

Robert Peston, the BBC's business editor, 15/11 2010

Until the country joined the European exchange rate mechanism in 1979, the Irish pound was virtually identical with the UK pound.

Samuel Brittan 18/11 2010

It was more than a fixed exchange rate. If you went on holiday to Ireland from England you did not have to convert any money. UK currency was generally acceptable even in the most fervently Republican areas. This did not always work completely the other way round. London cab drivers were not overenthusiastic about accepting Irish “punts”, but they ran no real risk in doing so. At a different level, some Irish banks operated indifferently across the island, as if the border with the North did not exist. And while some UK citizens liked and others disliked the many Irish residents in the country, there was no real feeling that they were foreigners. (I have always been struck by the parallel with Germany and Austria, a comparison disliked by my Austrian friends).

The breakaway from sterling in 1979 and later reflected as much political as economic factors. If the UK and the EU were at a parting of the ways, the natural instinct of Irish leaders was to go with continental Europe, even though it had some dubious economic consequences. There were times when Ireland had to go along with relatively low euro interest rates even when the Irish central bank made it quite clear that, given a free hand, it would have raised rates in the Republic. While the problems of other peripheral countries have reflected failure to align their costs and competitiveness with the euro heartlands, the Irish recession and debt are much more the after-effects of a financial binge, as in the case of the UK but on a magnified scale. The two economies hang together more than it is fashionable to admit.

The Good Friday agreements and subsequent progress may not have finally “solved” the problem of Northern Ireland, but the political atmosphere is much better than it has been for several decades; and in any splintering of the eurozone there should be fewer political obstacles to Ireland adopting sterling again, if that were in the country’s economic interests.

The conundrum is that the best course for Ireland would be to exit the euro zone,

depreciate its currency and restructure its bank debt.

Yves Smith, writes the blog Naked Capitalism, New York Times November 17, 2010

But euro zone leaders are just as afraid of a fracturing of the euro zone and imposing losses on still-weak banks as they are of voter wrath.

The only certainty is the evolving Irish crisis will prove to be interesting, and not in a good way.

The Irish government has issued guarantees to its banking system worth approximately 176 percent of Irish gross domestic product.

Irish banks, increasingly shut out of private markets, have grown ever more reliant on liquidity provided by the ECB.

Jacob F. Kirkegaard, research fellow at the Peterson Institute for International Economics,

New York Times November 17, 2010

Eventually, the central bank will turn off the tap, and the Irish government will have to accept the bailout to avoid domestic economic catastrophe.

Ireland borrowed and spent itself into a financial crisis.

Irish banks borrowed abroad and re-lent the money to Irish home buyers on the expectation that home prices would continue to climb.

When the real estate market collapsed, borrowers crashed, the banks came tumbling after, and so did the rest of the economy.

Sound familiar?

Jeffry A. Frieden, a professor of government at Harvard, author of Global Capitalism: Its Fall and Rise in the Twentieth Century."

New York Times November 17, 2010

Ireland

What is the fundamental problem that needs to be fixed?

And second, how can that problem be fixed?

Robert Peston, the BBC's business editor 18 November 2010

To state the obvious, and as I've been banging on about for days, it is the perceived weakness of Ireland's bloated, lossmaking banks that is the fundamental problem.

Is it the case that these hobbled banks would be able to borrow from commercial lenders again, and would become less dependent on the European Central Bank for funds, if all that happened was that a few more tens of billions of euros was injected into them as new capital, as additional protection against losses?

Or would investors and banks still be wary of lending to these banks, if they felt that the entity standing behind the banks - the Irish state - remained a credit of dubious worth?

Then there is the legendary good humoured fatalism of the Irish

“When you put your card in a cash machine these days and it says ‘Insufficient Funds’,

you can never be sure if it means you or the bank.”

Anatole Kaletsky

Auch deutsche Banken haben sich mit Milliardensummen in Irland engagiert.

Wo die Risiken liegen und wie viel Geld die einzelnen Institute im Feuer haben.

Handelsblatt 18/11 2010

SEK 796 miljarder

Dublin hopes to dress up any bail-out as aid for banks rather than the state,

but the distinction became meaningless when Ireland guaranteed its banks in September 2008.

Ambrose Evans-Pritchard, 18 Nov 2010 with nice pic

"The two are inextricably merged: it's an omelette that is impossible to unscramble," said Professor Brian Lucey from Trinity College Dublin.

He estimates the total cost of rescuing Anglo Irish and absorbing toxic debt through the 'bad bank' NAMA at €85bn.

€85bn x 9,37 = SEK 796 miljarder

Germany wants to bail out Ireland more than the Irish want to be bailed out.

The Irish financial problem, in contrast to the Greek one, is not caused by excessive government borrowing

but by the enormous losses suffered by the country’s private banks, which owe tens of billions of euros more

to their foreign creditors than they can expect to recoup from their dud property loans.

Anatole Kaletsky The Times November 17 2010

But banks in the eurozone can borrow unlimited funds from the European Central Bank and indefinitely avert failure.

This behaviour horrifies the Germans, who see that the ECB has been transformed from a bastion of monetary orthodoxy into a rehab clinic for bust banks

Cui bono? The banks, of course.

"Irland behöver EU:s lugnande tigerbalsam"

Läs här om Tigerbalsam

Krisen /för Irland/ bottnar i att boomen i alltför hög grad var lånedriven med banker som använde glädjekalkyler.

Däri ligger också den politiska skulden: man borde ha kylt ned marknaden.

SvD-ledare 18/11 2010

Att sätta stopp för oron för statsbankrutt handlar inte heller bara om Irland utan om rädsla för smitta till Portugal, Spanien och Italien

Trots sedvanligt larm och stoj har EU hanterat finanskrisens hyggligt.

Ju snabbare Irland nu sväljer den beska medicinen, desto lättare blir det att stilla marknadsoron

DN och SvD drar inga slutsatser av Irland och EMU

Rolf Englund blog 18/11 2010

När den amerikanska bostadsmarknaden dök sprack också den irländska fastighetsbubblan.

Bankerna kapsejsade under trycket av svajiga krediter och bostadsköpare som inte kunde betala sina lån.

Staten håller nu ett svårt sjukt finanssystem under armarna.

DN-ledare 18/11 2010

Självklart måste Irland fortsätta kampen mot sina budgethål. Hittills har landet gjort mer än de flesta, men det har inte räckt.

Otack är världens lön, kan säkert många irländare känna. Här har de under snart två års tid genomlevt brutala offentliga nedskärningar och lönesänkningar. Ändå straffar marknaden Irland med allt högre räntor på statspapper och en ny fas av finanskrisen.

Marknaderna fick skrämselhicka när förbundskansler Angela Merkel lovade att tvinga privata investerare att ta en del av förlusterna om ett euroland ställer in betalningarna.

DN och SvD drar inga slutsatser av Irland och EMU

Rolf Englund blog 18/11 2010

Europe heads back into the storm

Ireland’s basic problem is that it now has to choose between its own sovereign solvency and the solvency of its banks.

Other European countries – in and out of the eurozone – may soon face the same choice.

In such a world, keeping banks afloat with public capital risks sinking the sovereign

– and with it, the whole banking system.

Financial Times editorial November 17 2010

Supply side rabbits

How do you try to convince markets that an economy is going to grow even in the face of serious budget cuts, at a time of already high unemployment?

You produce some supply side structural reforms from a hat, et voila!

Kevin O’Rourke 16/11

This is how the IMF envisages getting growth in Greece, for example, and it is now being suggested that structural reforms will be a means of getting growth in Ireland as well:

I am a little confused by this. After all, it just a couple of months since Morgan Stanley provided a completely contrary reason for being bullish about Ireland:

Clearly, Ireland is facing major challenges in the quarters and years ahead. But, if there is one economy in the euro area that could meet such challenges, it is probably the Irish economy, in our view. Mind you, these strong preconditions are not a guarantee that Ireland will be able to overcome the challenges that lie ahead easily. But we believe that Ireland is fundamentally different from the other peripheral countries in that it is a fully deregulated, fully liberalised market economy. Hence, it should be able to adjust to the new environment and work its way out of the current situation more quickly.

The reason for my confusion is that if we are indeed fully deregulated and fully liberalised, it is hard to see where the Irish supply side rabbits are going to come from.

It is not an exaggeration to say that there would not be a banking system in Ireland - and therefore not an economy in any conventional sense

- if it weren't for the generosity of the European Central Bank in providing loans to Irish banks

that the markets won't provide.

Robert Peston, the BBC's business editor, 15/11 2010

The latest published figures, which almost certainly understate the true picture, show that the European Central Bank had lent 83bn euros to Ireland's domestic banks by the end of September and it had lent 130bn euros to all Irish credit institutions at the end of October.

Or to put it another way, ECB loans to Irish financial institutions were more-or-less equivalent to the current annual value of Ireland's Gross National Product.

To repeat, without the financial support of the ECB, Ireland would be bust right now.

Löpsedelstext från Dublin: 48 Hours to Save The Euro

Irland avvisar spekulationer om EU-stöd

Ekot 15/11 2010, med fin bild

I morgon och på onsdag möts EU:s finansministrar i Bryssel och då står Irland på agendan. Många håller det inte för otroligt att den irländske finansministern Brian Lenihan då ändå kommer att begära någon form av ekonomiskt stöd från EU.

Coca-Cola last week issued $4.5bn of three-year bonds on a rock-bottom coupon of 0.75 per cent.

Compare Coca-Cola with poor old Ireland whose three-year government bonds are now yielding 8.8 per cent.

Something is wrong.

Tony Jackson, FT November 14 2010

The Republic of Ireland is in preliminary talks with EU officials for financial support, the BBC has learned.

It is now no longer a matter of whether but when the Irish government formally

approaches the European Financial Stability Fund (EFSF) for a bailout

BBC 13 November 2010

The provisional estimate for EFSF loans is believed to lie between 60 bn and 80 bn euros, USD 82-110 bn.

The European Financial Stability Fund (EFSF) and The Permanent Crisis Resolution Mechanism (PCRM)

Rolf Englund blog 2010-11-12

"One of the most catastrophic political decision taken in post-war Europe"

The collapse of Lehman Brothers was without a doubt the single most symbolic moment of the financial crisis.

But for Europe it was on Tuesday, 30 September 2008, when the Irish prime minister gave a blanket guarantee for the entire banking sector.

Wolfgang Münchau, Eurointelligence 7/10 2010

The European Central Bank intervened to stabilise the Irish bond markets on Friday

after a report by a leading UK bank triggered investor fears that the country might turn to the international community for a multibillion-euro bail-out.

FT September 17 2010

The renewed bout of jitters sparked a half a percentage point jump in two-year Irish bond yields and pushed 10-year yields and the cost of insuring the country’s debt against default to record highs.

Ireland has shown what happens when you grasp the fiscal nettle, slashing public wages by 13pc –

to applause from EU elites – without offsetting monetary and exchange stimulus.

Ambrose Evans-Pritchard, 19 Sep 2010

Irish bonds have spiked even higher to a post-EMU record 6.38pc.

Two years into its purge, Ireland has a budget deficit near 20pc of GDP.

It is 12pc if you strip out the bank rescues, but the reason why the bad debts of Anglo Irish keep spiralling upwards is that

the economy keeps spiralling downwards. House prices have fallen 35pc. Nominal GDP has contracted 19pc.

It seems doubtful that the Celtic Tiger will ever roar again.

How did Ireland lurch into crisis once more

when most other European countries seem to have got to grips with their banking woes?

Sunday Times 3 oktober 2010

The problems began when Allied engaged in a destructive head-on battle for business with Anglo Irish Bank, its local rival. From 2003 to 2007, Allied lending to the Irish property and construction sector exploded from €6.7 billion to €30 billion. Right at the frothing peak of the market, from 2005 on, the bank doubled its exposure to the sector.

Ireland will take a majority stake in its second-largest bank, Allied Irish Bank

The bail-out costs will lift the fiscal deficit from the planned 11.75 per cent of gross domestic product in 2010 to 32 per cent.

This compares with the Maastricht treaty guidelines of 3 per cent.

FT, September 30 2010

Fintan O'Toole in the Irish Times:

"The choice is now stark: do we go on being "good Europeans" at the cost of destroying our own society or do we become "bad Europeans", lose the trust of our European partners, but save ourselves?"

Ambrose Evans-Pritchard, 08 Sep 2010

"There comes a point of existential crisis when even the meekest of countries has to put its vital national interests (first). We are at that point now," he said, deeming it the job of the ECB to shore up Anglo Irish if it thinks default poses systemic risk.

Fintan O'Toole in the Irish Times

This story is also not at all the way it’s being told. Yes, Ireland had fiscal austerity — but it also benefited from a devaluation and an inflationary boom in the UK.

Oh, and Irish interest rates fell sharply, which was possible because they were very high to begin with

So yes, you can boost your economy with fiscal austerity, as long as you also devalue your currency and sharply reduce interest rates.

Paul Krugman June 15, 2010

Our own single currency saw the exit of the Republic of Ireland in 1979 when the Irish pound free-floated against sterling.

It made sense for Ireland to express its nationhood with its own currency. The first impact was a modest devaluation against sterling, which helped to fuel Ireland’s great economic growth of the late 20th century.

Its surrender of its currency when it first entered the euro helped, as it gave Ireland lower interest rates that pumped up the credit bubble. Now it is a hindrance because it leaves Ireland less competitive.

John Redwood, The Times May 27 2010

Is the crisis coming back?

After the downgrading of Ireland by S&P, Irish sovereign bond spreads rose from 318bp to 344bp to level higher than before May, and even Greece spreads are now back at close to 10%, the level before the agreement on the EFSF. This means that the European rescue package have failed to calm down the market stress that triggered on those package in the first place.

There was further bad news from the US, where existing home sales declined by a record amount for July, giving rise to expectations of another decline in US house prices.

As ever, Calculated Risk has the best coverage of this.

The Wall Street Journal says in a comment that even a downturn to annualised growth rates of under 2% will feel like a recession.

In a 2% economy, there won’t be any job creation, or wage increases.

Eurointelligence 25/8 2010

The Irish Republic has had its credit rating downgraded

Thinks that the Irish government will spend 90bn euros helping the banks

10bn euros higher than previous estimates.

BBC 25/8 2010

The premium Ireland has to pay over Germany has risen to 3 percentage points

– the highest since March.

Ireland’s budget deficit, at 14 per cent of gross domestic product, is the biggest in the eurozone.

FT 17 August 2010

Ireland’s central bank governor, Patrick Honohan, added from Beijing that governments needed to convince investors that they would deliver on commitments to cut budget deficits. Ireland’s budget deficit, at 14 per cent of gross domestic product, is the biggest in the eurozone.

Concerns about Ireland rose last week after it unveiled a bigger-than-expected capital injection for nationalised lender Anglo Irish Bank.

Spreads on Irish 10-year bonds reached 297 basis points over German Bunds on Wednesday

amid reports the European Central Bank (ECB) is intervening to shore up Irish debt,

a reversal of the bank’s plans to withdraw emergency support.

The euro fell almost three cents against the dollar from $1.32 to $1.29.

Ambrose Evans-Pritchard, 11 Aug 2010

The latest jitters stem from the escalating costs of Ireland’s rescue of Anglo Irish Bank (AIB). The European Commission revealed this week that it had approved government support worth €24.3bn (£20bn) for the bank, significantly higher than estimates by Dublin earlier this spring.

The Irish Independent picked up these incredible comments from the Bundesbank in its monthly bulletin

in which it criticised Ireland, Spain, Portugal and Greece for running "persistently high" current-account deficits over the past decade,

which the Bundesbank says is a "source of danger" for the single-currency region.

Eurointelligence 20.07.2010

“Ireland's economic policies pose a danger to the eurozone as a whole and we should take measures to improve the economy ourselves rather than look to others to change”

(Interestingly, the Bundesbank does not think that persistent current account surpluses, which are the logical counterpart of current account deficits, constitute a “source of danger”. This suggests to us that the people who write these report are economically illiterate.)

Moody’s downgrades Ireland rating

Irish 10-year bond yields, which have an inverse relationship with prices, rose 8 basis points to 5.51 per cent, the highest level since the end of June.

FT July 19 2010

Reflections on a changed land

An Irish landscape of boom and bust

A Fortune writer tours the land of his ancestors for clues to the country's sudden fall from charmed to challenged.

photo gallery Fortune

Lars Calmfors, professor, DN Debatt 15/1 2010

Man kan försöka beräkna hur mycket den gemensamma ränta som ECB sätter för hela euroområdet skiljer sig från den ränta som skulle vara önskvärd för det enskilda eurolandet utifrån dess konjunktursituation.

European Economic Advisory Group har gjort sådana kalkyler /som/ tyder på att skillnaderna i konjunkturläge mellan länderna i dag är större än någon gång tidigare sedan EMU-starten.

Några euroländer har drabbats mycket mer av den pågående krisen än andra. Det gäller främst Irland, Spanien och Grekland.

De djupa nedgångarna i dessa länder beror dessutom i hög grad på att den gemensamma penningpolitiken inte tillräckligt motverkade de tidigare överhettningarna där med snabb kredittillväxt, fastighetsbubblor och kraftigare prisökningar än i omvärlden.

De mest aktiva EMU-förespråkarna har närmast velat förlöjliga argumentet om asymmetriska störningar. Men argumentet måste uppenbarligen även fortsättningsvis tas på största allvar.

Läs mer här

Varför ska Sverige gå med i EMU?

Framför allt Grekland, Irland och Spanien har under senare år haft kraftiga överhettningar som inte har dämpats tillräckligt av den gemensamma penningpolitiken.

Dessa överhettningar har bidragit till att de pågående konjunkturnedgångarna i dessa länder har blivit särskilt djupa.

Lars Calmfors Sieps JULI Nr 6-2009

Ireland will begin operating a new “bad bank” to house

€81bn in bad property loans left over from the financial crisis

and set out new capital requirements that are expected to see the further nationalisation of its banking sector.

FT, March 29 2010

The two biggest Irish banks, Allied Irish and Bank of Ireland tumbled Monday

Analysts expect the government to direct them to raise new capital to absorb

massive losses on bubble-era loans to real estate developers.

CNN March 29, 2010

Greece, Ireland, Portugal and Spain will cut the demand

So, unless as-yet-unspotted foreign cavalry ride to Europe’s rescue by buying up the continent’s products, aggregate demand will fall.

Less competitive Eurozone countries will be forced to deflate and shrink their economies to match Europe’s diminished and diminishing circumstances.

FT Editorial March 15 2010

People forget that one of the oldest currency unions in history, that between the UK and Ireland, was brought to an abrupt end when Ireland abandoned sterling – first for the European exchange rate mechanism and then for the euro.

Samuel Brittan, FT February 18 2010

With all the talk about debt crises last weeek, it is easy to forget that there is a real economic crisis afflicting Europe as well.

The fact that little Ireland is having to cut expenditure and raise taxes at a time like this will further worsen our own economic problems, but is of no broader consequence.

How many Irish people have even noticed what is happening in Latvia?

Kevin O’Rourke, The Irish Economy 14/2 2010

But if the entire periphery found itself having to fight market panic by cutting in an excessive fashion, simultaneously, that could be very dangerous — especially if Spain, or, God forbid, Italy, became involved as well.

Poland's Solidarity-era icon Lech Walesa will be in Ireland on Thursday and Friday to campaign for a "yes" vote to the EU's Lisbon Treaty ahead of the October 2 referendum, his office said.

Walesa, the shipyard electrician turned head of Poland's epic anti-communist Solidarity trade union, Nobel Peace Prize winner and former Polish president will be followed by European Commission president Jose Manuel Barroso who is planning a trip to Ireland on September 19.

Expatica 16/9 2009

Libertas leader rejoins battle against EU treaty

Irish millionaire and anti-Lisbon Treaty campaigner Declan Ganley has made a late and unexpected return to battle in the country's second referendum on the EU pact.

EU Observer 14/9 2009

Mr Ganley, the founder of Libertas - a eurosceptic political party which was hammered in the June EU elections - at a press conference in Dublin on Sunday (13 September) announced the revival of his anti-treaty operation, but this time on a much smaller scale.

Mr Ganley gave an extended interview to the Wall Street Journal, arguing that the very decision of European leaders to force a second referendum is reason enough to vote No again.

"Why, when the French voted No, the Dutch voted no and the Irish voted no, are we still being force-fed the same formula?" he said.

He also complained about Article 48 in the Lisbon Treaty, which according to Mr Ganley, allows EU leaders in future "with just intergovernmental agreement, with no need of going back to the citizens anywhere, [to] make any change to this constitutional document, adding any new powers, without having to revisit an electorate anywhere."

State of the Union - The Irish people had a vote on the Lisbon Treaty. They voted no.

"The Irish people had a vote on the Lisbon Treaty. They voted no.

A higher percentage of the electorate voted no than voted for Barack Obama in the United States of America.

No one’s suggesting he should run for re-election next month"

Declan Ganley, Irish Times, September 11, 2009

State of The Union

Vad är det som har en flagga, en nationaldag, en nationalsång, en militärstyrka, ett parlament och en högsta domstol.

En stat, naturligtvis. Vad är det mer en stat har? Jo, en valuta.

Det är därför europas ledande politiker har infört euron.

För att vara med om att rita om Europas karta, skapa ett nytt imperium, i Habsburgs efterföljd, som kan utmana USA, som vänstern hatar och högern föraktar.

Rolf Englund Internet 20/1 2003

Varför ska Sverige gå med i EMU?

Framför allt Grekland, Irland och Spanien har under senare år haft kraftiga överhettningar som inte har dämpats tillräckligt av den gemensamma penningpolitiken.

Dessa överhettningar har bidragit till att de pågående konjunkturnedgångarna i dessa länder har blivit särskilt djupa.

Lars Calmfors Sieps JULI Nr 6-2009

Påbörja konsolideringen 2010

Kommissionen har tagit första steget mot att starta budgetprocedurer mot Frankrike, Spanien, Grekland och Irland för att ha brutit mot stabilitetspaktens 3-procentsgräns.

Inga tidsgränser har ännu satts för när länderna måste sänka underskotten under 3 procent av BNP.

Det beslutet väntas fattas vid det informella ekofinmötet i Prag den 3-4 april.

Frankrike har villkorat korrigeringen av sitt underskott till den ekonomiska utvecklingen.

The Europe of Freedom and Democracy Group – the new eurosceptic party formerly known as the Independence-Democracy Group - announced its party name and political programme. The new party of 30 MEPs also intends to campaign against the Lisbon Treaty in the second Irish referendum likely to be held this October, with the party's co-president, Nigel Farage of UKIP, laying down a strong marker at the party's first meeting in the European parliament. EU Observer 1/7 2009

Mr Farage said Irish voters had already rejected the Lisbon Treaty in a referendum last June,

just as French and Dutch voters rejected the similar Constitutional Treaty in 2005,

but politicians were not willing to listen to their responses.

The wording below of the proposed Lisbon “guarantee” in Section A of today’s European Council decision or agreement, even if it were given binding European Treaty status by opening and adding a Protocol to the Lisbon Treaty, which is not intended - is about as useful as a gate in the middle of a field!

It purports to restrict the effects of the Lisbon Treaty on the Irish Constitution in ONLY ONE SMALL AREA - “the area of Freedom, Security and Justice“,

which is only one of 13 areas of shared competences in the EU, i.e. shared between the Union and its Member States.

The National Platform - For a Europe of Independent Democratic Co-Operating Nation States, june 2009

EU leaders have agreed a deal they hope will secure the Lisbon Treaty

a "Yes" vote in a second Irish referendum.

BBC 19/6 2009

Ireland won legally-binding assurances that Lisbon would not affect Irish policies on military neutrality, taxes and abortion, diplomats said.

French President Nicolas Sarkozy said leaders had agreed to Irish demands that the guarantees would be given the status of a treaty "protocol".

"legally binding decisions which clarify but do not change the treaty text"

The summit conclusions spell out that other EU member states do not need to ratify the treaty again on foot of the guarantees given to Ireland.

Irish Times June 20, 2009

That assurance was especially important for British prime minister Gordon Brown, facing a Conservative opposition hostile to the treaty.

The conclusions say explicitly that these are legally binding decisions which clarify but do not change the treaty text. This further confirms that the ratifications already made by other member states stand. The one substantive change since last year’s referendum, that each member state will retain a European commissioner, will be made on foot of a political not a textual decision – but only if the treaty is ratified here and elsewhere.

Despite the many political changes since the last referendum, including the definite shift in public opinion in its favour, its ratification cannot be taken for granted. A strong campaign based on civil society as well as political parties is needed to pass it, backed by determined efforts to inform voters on its real contents and a fair media debate concentrating on different points of view rather than distorted facts.

Ireland is ECB's sacrifical lamb to satisfy German inflation demands

Put bluntly, Ireland is being forced to roll back the welfare state and tighten fiscal policy

in the midst of a savage economic contraction

in order to uphold the deflation orthodoxies of Europe's monetary union.

Ambrose Evans-Pritchard, Daily Telegraph 12 Apr 2009

If Ireland still controlled the levers of economic policy, it would have slashed interest rates to near zero to prevent a property collapse from destroying the banking system.

The Irish central bank would be a founder member of the "money printing" club, leading the way towards quantitative easing a l'outrance.

Mr Lenihan hopes to shield banks from the calamitous consequences by creating a buffer agency. It will soak up €80bn to €90bn in toxic debt – or 50pc of GDP.

He borrowed the plan from Sweden's bank rescues in the early 1990s, but overlooks the key point

– it was not the bail-out that saved Sweden's financial system,

the country recovered only by ditching its exchange peg and regaining its freedom of action.

Depression buffs will note the parallel with Britain's infamous budget in September 1931, when Phillip Snowden cut the dole and child allowance to uphold the deflation orthodoxies of the Gold Standard – though in that case the flinty Pennine rather liked hair-shirts for their own sake.

Though few had any inkling at the time, Snowden's austerity drive would soon push British society over the edge. It set off a mutiny – a Royal Navy mutiny at Invergordon over pay cuts, in turn triggering a run on sterling. The pound was forced off Gold within days. Irish deliverance from EMU will not be so easy.

Ireland was betrayed by the European Central Bank, which opened the monetary floodgates early this decade to nurse Germany through a slump, holding rates at 2pc until late 2005, despite flagrant breach of the ECB's own M3 money targets.

Fast-growing Ireland and the Club Med over-heaters were sacrificed to help Germany.

Construction reached 21pc of GDP – a world record? – compared with 11pc in the US at the peak.

The success of the Irish government’s plans to set up a “bad bank” rests on details that have not yet been finalised.

The loans have a nominal value of €80bn-€90bn – about half of Ireland’s annual economic output.

Financial Times April 8 2009

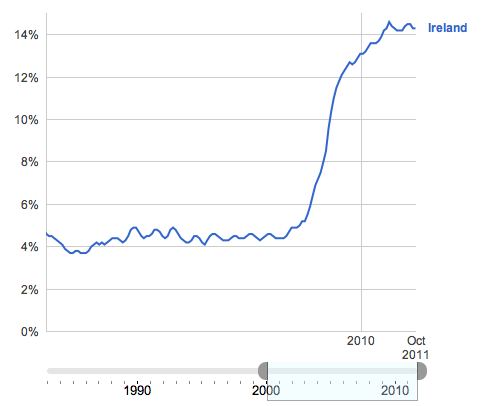

Irlands ekonomi står inför en djup svacka.

Priserna faller, arbetslösheten är på väg upp över 14 procent och