Stabilitetspakten

Frankrike - Italien - Spanien - Tyskland - Spricker

Göran Persson om EMU och federalismen i boken "Den som är satt i skuld är icke fri"

Det är inget tvivel om att både tyskar och fransmän är inriktade på att klara detta, trots sina bekymmer.

Det sätter en norm för framtiden och därför känner jag mig trygg i den delen.

Göran Persson i Tiden (s) nr 3, 2003

Stabilitetspakten nödvändiggör buffertfonder

BBC: Q&A: What is the European stability pact?

Konkret består stabilitets- och tillväxtpakten av en resolution från Europeiska rådet (antagen i Amsterdam den 17 juni 1997) och av två rådsförordningar av den 7 juli 1997 som anger detaljerna för pakten (övervakning av de offentliga finanserna och samordning av den ekonomiska politiken; genomförandet av förfarandet vid alltför stora underskott). Efter diskussioner om hur stabilitets- och tillväxtpakten ska fungera ändrades de två förordningarna i juni 2005.

Läs mer här

European Commission warns Italy it must act to cut national debt

FT 23 May 2018

Eurokrisen och Finanspakten: Ur askan i elden

Stefan de Vylder, 2013

Är Stabilitetspakten Stupid?

Olli Rehn, Prodi och Persson

Rolf Englund blog med länkar, 6 maj 2012

Monti called the breaches of the Maastricht Treaty limits on deficit ceilings by France and Germany,

soon after the launch of the single currency, the "worst mistake in the EU in the past ten years".

CNBC 11 Jan 2012

SPIEGEL Interview with Ex-ECB Chief Economist Issing

Issing: My confidence in the sustainability of such resolutions has always been limited. But it was completely shaken when Germany and France mutually killed the pact in 2003. At the time, several European finance ministers said to me: How are we to convince our citizens to support a stability pact if not even Germany wants to abide by it?

Otmar Issing, Der Spiegel 23/3 2011

Sverige, Estland och Luxemburg

Den ekonomiska krisen har slagit sönder många länders offentliga finanser.

3 av 27 länder som inte är föremål för EU:s underskottsförfarande

Anders Borg DN Debatt 2010-07-13

The French and the Germans have once again been discussing whether /Stability Pact/ sanctions should be automatic or not.

For Jean-Claude Trichet to issue an official note of disagreement – after European Union finance ministers last week drafted a watered-down sanctions package – is extraordinary

Wolfgang Münchau, FT 25/10 2010

The real irony is that the pact, in whatever form, is not even relevant to the eurozone’s future. This may be a shocking statement. But look at the evidence. Contrary to popular narrative, fiscal profligacy played only a minor role in the eurozone’s sovereign debt crisis. Successive Greek governments cheated, but on my information, this occurred with at least partial knowledge of the senior European officials involved in the process. They chose not to apply the pact for political reasons.

Den europeiska stabilitetspakten var feltänkt från början

eftersom det inte är realistiskt med böter mot länder i ett läge just när de har stora budgetunderskott.

Lars Heikensten, DI 2010-07-06

Om Sverige hade varit medlem i EU i början av 1990-talet hade vi i så fall kanske lämnat unionen vid vår 90-talskris, säger Heikensten

EMU är fast växelkurs in absurdum. Om det går illa för Tyskland, vilket det nu gör, kan Tyskland inte ändra sin växelkurs, den ligger fast för alltid, eller åtminstone till EMU kraschar, vilket det kommer att göra.

Det kommer att ske när dollarn faller och Europa drabbas av massarbetslöshet.

Och så är det den förfärliga Stabilitetspakten. Den bygger på den i grunden felaktiga tanken att när det blir dåliga tider och statens skatteinkomster sjunker och utgifterna för arbetslösheten ökar, då skall staten skära ner på sina utgifter eller höja skatterna.

Rolf Englund i EU-krönika i NWT 2001-08-10

New rules are needed to underpin the eurozone in the post-crisis world. The stability and growth pact has failed.

To avoid moral hazard, these rules must admit the possibility of sovereign default.

FT editorial July 13 2010

SPIEGEL: Despite all of these efforts, the central problems with the euro remain. Strong economies belong to the same currency union as weak ones like Greece. Is the euro not doomed to failure?

Thomas Mirow, head of the European Bank of Reconstruction and Development:

There are also big differences between the states in the US.

The question is, to what degree are the states there for each other and if there are effective balancing mechanisms. That was kept from the public for a long time.

Der Spiegel 6 July 2010

"intellectually and politically schizophrenic"

The current debt crisis is a direct result of a governance structure for the single currency that was excessively respectful of national economic sovereignty.

Peter Sutherland, former European Union commissioner, FT 30 June 2010

The “stability pact,” could never be a reliable foundation upon which to build. Its implementation was to be left to national governments and they themselves would be entitled to vote on whether they should be sanctioned for breaches of the pact. The current debt crisis is a direct result of a governance structure for the single currency that was excessively respectful of national economic sovereignty.

The implausible insistence that Greece’s financial problems were a matter for Greece only was the surest possible way of ensuring that they would become a pressing matter for the whole eurozone.

The chances that governments would obey the rules did not exactly brighten when

Romano Prodi, Commission president from 1999 to 2004, asserted in October 2002 that the stability pact was “stupid”

because it provided for sanctions on countries already in financial difficulties.

Tony Barber, FT October 11 2010

“He’s an honest man, dedicated to European integration. His heart is in the right place. But we felt straightaway that he shouldn’t have said that,” says one former commissioner.

A big step towards fiscal federalism in Europe

When the euro was born everyone knew that sooner or later a crisis would occur.

It was also clear that the stability and growth pact was – as I have said before – “stupid”

Romano Prodi FT May 20 2010

When the euro was born everyone knew that sooner or later a crisis would occur. It was inevitable that, for a such a bold and unprecedented project, in some countries (even the most virtuous ones), mistakes would be made and unforeseeable events occur.

It was also clear that the stability and growth pact was – as I have said before – “stupid”, not because it was mistaken in its objectives, but because it was founded on purely mathematical parameters without any discretionary powers or political instruments to enforce it.

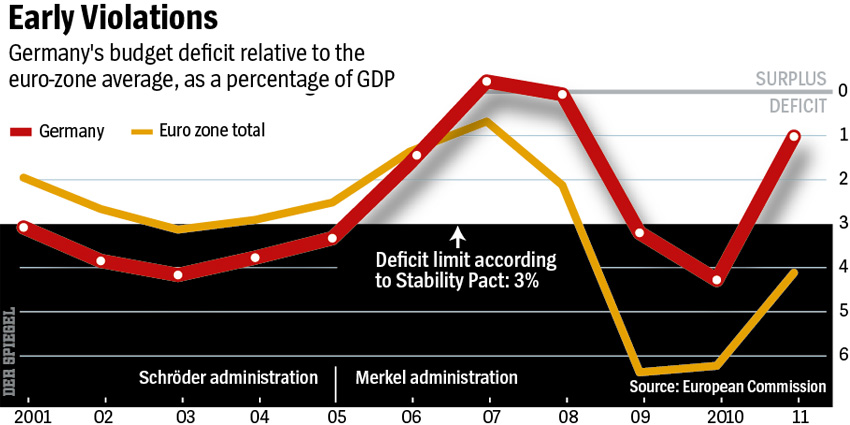

Germany and France were the first countries to violate it, although not in a destabilising way: their finance ministers decided to ignore the objections of the European Commission (possibly because they were “too big to fail”).

Due to political difficulties it was not possible to protect the euro. I was warning years ago that, through no one’s fault in particular, extraordinary events could occur that would force joint co-ordination of fiscal policies. Then the Greek crisis arrived

*

"We must now face the difficult task of moving forward towards a single economy, a single political entity...

For the first time since the fall of the Roman Empire we have the opportunity to unite Europe."

Romano Prodi, EU Commission President, speech to European Parliament, 13th October 1999.

*

"I am sure the euro will oblige us to introduce a new set of economic policy instruments.

It is politically impossible to propose that now. But some day there will be a crisis and new instruments will be created."

Romano Prodi, EU Commission President. Financial Times, 4 December 2001

Det blir inga Europas förenta stater,det kan jag lova! utbrast Lena Hjelm-Wallén.

Själv ser /Göran Persson/ faror som är långt farligare än Greklandskrisen.

– Jag trodde en gång i tiden att stabilitetspakten var lösningen på den här knuten, men det visar sig att den inte var det. Så då får man väl hitta en annan konstruktion. Det är klart att jag vill se hur den ser ut innan Sverige kan gå med.

– Svenska folket har sagt nej till ett euromedlemskap med tydlig majoritet. Vi ska inte aktualisera en ny folkomröstning förrän vi har ett riktigt folkligt krav på det. Och det har vi inte idag

Göran Persson. e24 2010-05-19

"Ländernas konkurrenskraft har också betydelse för valutans stabilitet."

DN huvudledare 7/5 2010

"Slutsatsen är att det behövs grundligare kontroller och analyser av både euroländernas statsbudgetar och ekonomier. Det var förödande att de politiska ledarna vid 2000-talets mitt luckrade upp stabilitetspaktens regler, men ländernas konkurrenskraft har också betydelse för valutans stabilitet."

Germany

Four professors will launch a legal challenge in early May at the Verfassungsgericht (high court).

Should they secure an injunction, EMU may fly apart.

EMU shut the warning signals, disguising risk.

What investors overlooked is that currency risk mutates into default risk in a monetary union

The EU-IMF "therapy" of deflation for Greece repeats the catastrophic errors of Chancellor Heinrich Bruning in the early 1930s and must lead to a depression

Ambrose Evans-Pritchard, 25 Apr 2010

Frankfurter Allgemeine Zeitung oozed indignation.

“Germany is meant to take responsibility for Greek debts – that’s not how the idea of the euro was sold to the Germans,”

the conservative newspaper noted in reference to the single currency’s founding treaty, which banned bail-outs.

Financial Times February 11 2010

Överskottsmålet bör behållas på nuvarande nivå och i nuvarande form, men

bestämmas i lag och följas upp tydligare.

Finansdepartementet i en departementsskrivelse 1 februari 2010

Uppföljningen av målet kan dock bli tydligare. Det gäller bland annat vilka indikatorer som bör användas för att följa upp överskottsmålet och hur regeringen tar hänsyn till konjunkturläget vid uppföljningen.

Arbetsgruppen poängterar samtidigt att uppföljningen inte får bli för mekanisk. Det riskerar att leda politiken fel. Hänsyn måste också tas till osäkerheten i bedömningen och riskbilden. Att regeringen skulle vikta de olika indikatorerna som Riksrevisionen och Finanspolitiska rådet föreslagit avråder arbetsgruppen från, eftersom det skulle ge en för mekanisk uppföljning av överskottsmålet.

Stålbad för greker och press på euron

Den statsfinansiella krisen i Grekland har vuxit till den största oroshärd som eurosamarbetet haft att hantera sedan euron infördes 1999.

Greklands budgetunderskott ska enligt den nu godkända stabilitetsplanen från Aten dras ned under taket på 3 procent av BNP i EU:s stabilitetspakt till 2012, en ambition man delar med rader av europeiska regeringar som till följd av finanskris och recession bryter mot paktens regler.

DN/TT 2010-02-03

A principled Europe would not leave Greece to bleed

Trichet failed to note that there had long been a double standard – in effect two Maastricht treaties, one for the large and powerful countries, another for the smaller and less powerful.

When France broke the EU edict not to let debt exceed 3% of GDP, there were strong words, but little else.

Joseph Stiglitz guardian.co.uk, 25 January 2010

For the ECB to announce that it will not accept Greek bonds as collateral would be counterproductive. For the ECB to delegate judgments about the credit-worthiness of Greek bonds to the rating agencies would be more than just irresponsible; it would be reprehensible /Synonyms: blameworthy, blamable, blameful, censurable, culpable, guilty, reprehensible. /blameworthy behavior; blamable but understandable resentment; blameful impulsiveness; censurable misconduct; culpable negligence; guilty deeds; reprehensible arrogance./

With Europe's economy still weak, an excessively rapid tightening of its budget deficit would risk throwing Greece into a deep recession.

We are headed towards a situation in which the risk of financial distress and contagion leads to an unconditional bail-out, whether or not Greece is reforming sufficiently.

The reasons we are at this juncture lie in the nature of the stability and growth pact. It is a fair-weather construction, ill-suited to crisis.

Wolfgang Münchau, FT December 13 2009

I almost fell off my chair when I heard Angela Merkel say that the European Union might sometimes have to take charge of the fiscal policies of highly indebted members. Does this mean that the German chancellor is abandoning her attachment to a rules-based system of fiscal policy co-ordination? Probably not quite

Thirteen members of the European Union have been told to take action and get their budget deficits back in line.

EU requirements mean that they should not exceed 3% of the country's GDP.

However, since the financial crisis most countries have broken that rule.

BBC 11 November 2009

Deadlines ranging from 2012 to 2014 have been issued.

France, the UK, Spain and the Irish Republic have longer to comply because their economies have worsened since the original deadline was imposed in April.

France has already warned that it will not meet the new deadline. The government wants to focus on boosting growth rather than cutting spending.

Germany and six other countries have until 2013.

Belgium and Italy have the tighter deadline of 2012

EU's economy commissioner, Joaquin Almunia, saved his harshest criticism for Greece. Mr Almunia said the country had taken "no effective action".

Time for the ECB to get serious about the overvalued euro

The euros nominal and real appreciation since the end of 2000, resumed with a vengeance during 2009.

The strength of the currency is hurting the exporting and import-competing sectors of the Euro Area.

Unemployment and excess capacity continue to rise.

Willem Buiter's Maverecon October 18, 2009

EU economies are bound by the Stability and Growth Pact which limits budget deficits to three percent of GDP.

However a 2005 revision of the pact allows government's to exceed this level under exceptional circumstances,

an alteration they have taken full advantage of in the current climate.

Twenty of the EU's 27 members have now been the subject of some form of deficit action from the European Commission, meaning a report with a timetable to bring deficits down.

EU Observer 20/10 2009

Forecasts released earlier this year by the former centre-right government of Greece predicted a deficit of 3.7 percent of GDP for 2009. But new figures released by the country's central bank now say it is more likely to exceed 10 percent of GDP, and could hit 12 percent.

"I have to say that I am very impressed by the difference between the old and the new figures," said the meeting's chairman, Jean-Claude Juncker, with characteristically dry sense of humour.

Anders Borgs plan för balans i EU-ekonomin

Mats Hallgren, Svde24 2009-07-07

Ireland is ECB's sacrifical lamb to satisfy German inflation demands

Put bluntly, Ireland is being forced to roll back the welfare state and tighten fiscal policy

in the midst of a savage economic contraction

in order to uphold the deflation orthodoxies of Europe's monetary union.

Ambrose Evans-Pritchard, Daily Telegraph 12 Apr 2009

It could be that future generations of German politicians find ingenious ways around the balanced budget law.

Or that they find a two-thirds majority to overturn it.

Or that Mr Sarkozy or his successors follow Germany into a future of austerity.

But as long as one of those three events fails to happen, Germany may discover that unilateral fiscal rigour in a monetary union could prove extremely costly.

For the sustainability of the euro, you surely do not want to get into a position where a large member state has a rational economic reason to quit.

So if Germany and France really do what they both promise, you may as well start the egg timer.

Wolfgang Münchau, Financial Times June 28 2009

A decision was taken recently in Berlin to introduce a balanced-budget law in the German constitution.

It was a hugely important decision.

From 2016, it will be illegal for the federal government to run a deficit of more than 0.35 per cent of gross domestic product.

From 2020, the federal states will not be allowed to run any deficit at all.

Unlike Europe’s stability and growth pact, which was first circumvented, later softened and then ignored, this unilateral constitutional law will stick.

I would expect that for the next 20 or 30 years, deficit reduction will be the first, second and third priority of German economic policy.

Wolfgang Münchau, FT. June 21 2009

"Some thougths about the future of the euro"

The real threat to the cohesion of the monetary union is not Italy, or even a post-property-crash Spain.

The real issue is the political gulf between France and Germany.

Susanne Mundschenk and Wolfgang Münchau, Eurointelligence 18/10 2007

Jag undrar hur länge det dröjer innan det stora staterna i Europa börjar på att säga att

det är orimligt att all makt ligger hos Centralbanken

Fransmännen talar ju redan om ett stabilitetsråd

och om man skall lyfta dessa saker till europeisk nivå, vilket jag mycket väl tror

kan bli resultatet av EMU,

då byter vi karaktär på den europeiska unionen och går mot en mer

federativ lösning.

Göran Persson 1997-10-13

Professor Paul de Grauwe

"Without further steps towards political union, the eurozone has little chance of survival"

Ambrose Evans-Pritchard, Daily Telegraph 16/7 2007

At no time were the countries of the European Union economically prepared to adopt a single European currency.

Yet political expediency accompanied by jealous anti-Americanism led 12 European countries to surrender national monetary policy without the necessary ingredients in place for an optimal currency area, especially labour mobility and fiscal equalisation.

Ironically, in the planning phase of this exercise Germany was concerned that its long-term record of low inflation might be put at risk by Italian fiscal profligacy in a currency union. It was Germany, therefore, that drafted and imposed the stability and growth pact on all future eurozone participants.

Uwe Bott, President, Cross-Border Finance, New York, Letters FT 20/1 2005

EU's Prodi Calls Deficit

Reduction Accord `Stupid'

Paris, Oct. 17 (Bloomberg)

Comment by Rolf Englund:

Of course the Stability Pact is stupid.

But the real intent of the pact was to calm the german voters fear.

Now the pact can be amended.

infrastructure

While a simplistic stability pact may have been the right choice when the euro was in its infancy,

Europe can no longer afford to stick with such a rudimentary instrument.

Mario Monti FT 8 October 2014

By failing to recognise the proper role of public investment, it has pushed governments to stop building infrastructure just when they should have built more.

The stability pact, by and large, is not currently complied with.We cannot speak of compliance when member states can easily secure extensions to deadlines for meeting the targets.

France did not even ask permission but simply announced that it would not comply.

Mario Monti FT 8 October 2014

Italy chimed in that the EU should not dare to consider this an infringement

- Jag vet hur viktig stabilitetspakten är för mig som anhängare av en nationell finanspolitik men en europeisk penningpolitik.

Det som ska förena eld och vatten där är stabilitetspakten.

Göran Persson i Europa-Posten nr 7/2002

Vi ser nu att stabilitetspakten verkligen honoreras.

Det är inget tvivel om att både tyskar och fransmän är inriktade på att klara detta, trots sina bekymmer.

Det sätter en norm för framtiden och därför känner jag mig trygg i den delen.

Göran Persson i Tiden (s) nr 3, 2003

Monti called the breaches of the Maastricht Treaty limits on deficit ceilings by France and Germany,

soon after the launch of the single currency, the "worst mistake in the EU in the past ten years".

CNBC 11 Jan 2012

Q&A: The battle over EU fiscal rules

Peter Spiegel, FT August 28, 2014

Italy’s PM Matteo Renzi wants the EU’s budgetary rules to be interpreted more loosely – so that money spent for ‘growth-enhancing’ purposes does not count as part of the budget deficit.

At a summit at the end of June, EU leaders agreed that they should make “best use” of the flexibility in the Stability and Growth Pact.

Crucially however, the rules were to remain the same.

Nevertheless Italian officials have been holding this up as a significant blow-to-austerity victory.

EU Observer 7 August 2014

Rehn: The French government has begun structural reforms, but the economic outlook has also simultaneously and unexpectedly worsened. France must now persuade the European Commission and its European partners that it will get its public finances in order in medium-term.

SPIEGEL: What use is it, then, if Europe obliges itself to ever greater budgetary discipline, but in reality is constantly making concessions?

Rehn: I don't make any trade-offs when it comes to the Stability Pact rules. The reformed pact places an emphasis on making public finances sustainable in the medium-term. In the short term, certain divergence can be accepted under the condition that a country is implementing reforms.

So we are relying on partnerships, but we are also prepared to initiate sanctions instruments if necessary.

Olli Rehn, Der Spiegel 4 March 2013

In the early 2000s, Germany was struggling to adhere to euro-zone criteria aimed at ensuring common currency stability.

Instead of introducing austerity, however, Chancellor Gerhard Schröder simply launched an effort to change the rules.

New documents show just how key his role was in weakening the Stability Pact.

Der Spiegel, 16 July 2012

Den europeiska mardrömmen

Tyskland är inte Sverige i kvadrat. Tysklands problem är långt värre än så.

Arbetslösheten överstiger 10 procent, tillväxten är närmast obefintlig, budgeten går med underskott,

banksystemet skakar, risken för deflation är överhängande och landets industri befinner sig i en svår kostnadskris.

Den tyska utvecklingen är en europeisk mardröm, vars slut vi ännu inte sett skymten av.

Peter Wolodarski DN 27/4 2003

När den första Greklandskrisen bröt ut våren 2010 kunde euroländerna välja mellan två vägar:

1. Respektera fördragsbestämmelserna om att EU-institutioner och övriga länder inte får ta över ansvaret för ett enskilt medlemslands statsskuld.

2. I stället bryta mot fördraget och ge finansiellt stöd.

Som bekant valdes väg 2.

Lars Calmfors, Kolumn DN 27 juni 2012

Ett skäl var rädslan för att statsbankrutter skulle skapa en ny finanskris. Ett annat skäl var den felaktiga uppfattningen att euron inte skulle överleva statliga betalningsinställelser.

The next government in Germany should start to cut spending by 2011 at the latest

to help achieve a balanced budget, European Union finance ministers said at a meeting in Brussels today.

Bloomberg March 10 2009

After conducting “expansionary” fiscal policy this year and next to combat its deepest recession since World War II, Germany should “reverse the fiscal stimulus in order to support significant budgetary consolidation,” the EU finance chiefs said in a reply to budget plans presented by Germany.

Jean Claude Juncker announced that

the deadline for a balance budget is postponed from 2010 to 2012

Eurointelligence 3/6 2008

By the way, the finance ministers chose a most interesting venue to announce the new policy of fiscal profligacy – the halls of the European Central Bank, which celebrated its 10th birthday yesterday. Quite a birthday present!

Germany needs to formulate a response to Sarkozy or the only proposal on the table will be Sarkozy’s anti-stability, anti-competition, pro-currency-intervention proposals.

Wolfgang Münchau, Eurointelligence 12/7 2007

Sarkozy’s postponement of the balancing of France’s budget in compliance with the European Union stability and growth pact by two years until 2012 has immediately attracted widespread condemnation by the European Commission and several EU governments

This hurried, almost mechanical reaction is misguided

Charles Wyplosz, FT July 5 2007

I would expect serious political tensions to emerge inside the eurozone – especially between France and Germany.

One should remember that the euro would not exist today if during the 1990s these two countries had not papered over their philosophical differences over the right conduct of monetary and fiscal policy.

Wolfgang Munchau, FT July 2 2007

Another source of conflict is Mr Sarkozy’s repeated threat of a co-ordinated policy to drive down the euro’s external exchange rate. I assume a new exchange-rate strategy is what Mr Sarkozy has in mind as he plans to set out his vision for greater economic policy co-ordination within the eurozone at the next Ecofin meeting in Brussels. I am not sure how Angela Merkel, the German chancellor, will react to this. But when Mr Sarkozy attacked the European Central Bank during his election campaign, Ms Merkel immediately paid a visit to Frankfurt to demonstrate her commitment to the central bank’s independence and the goal of price stability.

Faktum är att de flesta av EU:s stora projekt ligger i ruiner.

Stabilitetspakten som skulle garantera budgetdisciplin hos EMU-medlemmarna har ingen legitimitet sedan både Tyskland och Frankrike bryter mot den, för att inte tala om Italien.

PM Nilsson, Expressen 25/3 2007

Joaquín Almunia, EU monetary affairs commissioner 280-page report on the low pace at which countries have adapted to the euro since its launch in 1999.

fear that a downturn could exacerbate problems in unreformed economies and heighten political and public criticism of the euro

Financial Times 23/11 2006

His report warns finance ministries that the current economic upswing masks long-term problems which could undermine the euro’s stability. It focuses on countries that deviate most from the eurozone average in growth, inflation and competitiveness: Germany, Italy, the Netherlands, Portugal, Spain and Ireland.

Mr Almunia’s reports says such divergences, if they continue, could lead to tensions and complicate the eurozone’s “one-size-fits-all” interest rate policy.

The biggest headaches are Italy and Portugal

Spain has boomed in the eurozone with low interest rates fuelling a massive rise in house prices, but the report highlights problems.

He admitted that citizens had yet to be convinced of the euro’s benefits, hinting at political problems if they came to believe the single currency was harming national economies.

However, Mr Almunia and Jean-Claude Trichet, governor of the European Central Bank, fear that a downturn could exacerbate problems in unreformed economies and heighten political and public criticism of the euro.

"tensions" from "persistent divergences in growth and inflation" among its members, the European Commission warned

The report represents one of the sharpest official warnings that the euro remains fragile

Wall Street Journal 23/11 2006

In a report, the commission said the euro has established itself "as a strong and stable currency" in the eighth year of its existence, but warned that "this is not to say that the euro area is functioning with full efficiency," pointing to continued high inflation and high growth in countries such as Greece and Ireland, compared with sluggish performance and small price rises in Germany and France.

The report represents one of the sharpest official warnings that the euro remains fragile and was accompanied by calls for better coordinated fiscal policies among the 12 countries that use the currency.

Jean-Claude Juncker, the Luxembourg prime minister and euro-group chairman, said that finance ministers must work more closely with the European Central Bank and that the zone's inflation and growth gaps pose "a potential problem for cohesion" if the current economic recovery peters out.

Comment by Rolf Englund:"a potential problem for cohesion" = Eurospeak för att EMU kan spricka

Gilles Moec, an economist at Bank of America in London, said inflation-rate differences in U.S. states are as great as those between European countries and that "when California is booming thanks to the IT cycle, Detroit may be doing badly." But Mr. Moec noted that the single U.S. fiscal policy makes a difference. "In the U.S., a big divergence would lead to Keynesian reaction to minimize it, but in Europe, the central EU budget remains quite small," he said.

Individual governments, using the same monetary policy, retain power over spending and EU officials lament that no strong rules exist to control their behavior. Although deficits are shrinking, officials yesterday said this could change in an economic downturn as each government fights for itself.

Jean-Claude Trichet, European Central Bank president, on Friday delivered a stiff warning to eurozone finance ministers to back off in an escalating dispute over the bank’s independence.

Mr Trichet pointed out that it was his signature on euro banknotes and that it was unlawful under the EU treaty for finance ministers to give instructions or try to influence the bank.

Financial Times, 9/9 2006

Jean-Claude Juncker, Luxembourg prime minister, was on Friday given a second two-year term as political head of the eurozone.

Mr Juncker said he had only agreed to carry on chairing the eurogroup – the political arm of the single currency – after finance ministers supported his plan to have an "intensified dialogue" with the ECB.

He said he "fully respected" the principle of independence for the ECB and that he did not want to influence its decisions, but...

Europe has to face threat of US trade deficit

This cumulative process could be enough to send some European economies into recession.

With this separation of monetary and fiscal responsibilities, there is virtually no feedback from larger budget deficits in the form of higher interest rates and a weaker currency that would otherwise discipline fiscal authorities. The revision of the growth and stability pact only exacerbates this problem by substantially weakening the Maastricht treaty that required eurozone countries to limit their fiscal deficits and national debt.

Martin Feldstein, FT August 1 2006

Stability pact

In a report to be published on Tuesday, Mr Almunia will say.

"On average the structural balance for the EU [in 2006] will not improve and for some member states will even deteriorate, turning the fiscal stance expansionary and pro-cyclical."

Financial Times 13/6 2006

Joaquin Almunia, EU monetary affairs commissioner, is due to say that finance ministries have not kept their promises under the new-look stability and growth pact to use the good times to put their finances in order.

One year after the pact was rewritten, Mr Almunia is to argue that the loosened fiscal code has worked better than expected in bringing the worst budgetary offenders like Germany and France into line.

Germany’s national economic strategy consists of two planks, budgetary consolidation and a beggar-thy-neighbour real devaluation inside the eurozone as Germany improves its competitiveness through wage moderation.

One could make a case for budgetary consolidation during a cyclical upswing, but a systemic policy of real devaluation is destructive from the perspective of the eurozone as a whole.

Wolfgang Münchau, Financial Times 15/5 2006

As the economy goes through a cyclical upswing, one would have expected the period of wage moderation to come to an end. But the opposite is the case. Real wages not only continue to decline, but do so at an increasing rate. No wonder domestic consumption is so weak. If people expect to earn less money in future, they hold back on consumption today. German consumers act in a far more rational manner than they are usually given credit for.

Instead of seeking to resist the dollar’s shift to a more competitive level,

governments in Europe and Asia should focus on developing policies to maintain aggregate demand in their individual economies as their export sales decline.

Martin Feldstein, Financial Times 26/5 2006

Knyt kronan till valutasamarbetet

Lars Calmfors på DN Debatt 1990-09-11

- Det borde ha stått klart för alla att kollisionen mellan denna valutapolitik och de tidigare kostnadsstegringarna i kombinatione med den internationella konjunkturnedgången, finans- och och fastighetskrisen och neddragningarna i offentlig sektor riskerade att skapa en sysselsättningskatastrof.

Hur ska man förklara den närmast dogmatiska envishet med vilken åtgärder för att motverka den exceptionella sysselsättningsnedgången avvisats?

Lars Calmfors på DN Debatt 92-11-26

Vid presentationen av Lars Calmfors rapport om stabilitetspakten deltog statsminister Göran Persson som åhörare. Han förklarade sig också vara bekymrad över den kris som pakten har hamnat i

- Stabilitetspakten står och faller med Tysklands nya regering. Nu måste de två stora partierna, kristdemokrater och socialdemokrater, hitta lösningar tillsammans. Jag hoppas på Angela Merkel och Franz Müntefering, eftersom alternativet är så skrämmande, kommenterade Göran Persson.

Ref i DN 9/11 2005

Han skilde sig från Lars Calmfors som anser att stabilitetspakten inte längre går att rädda, efter den långa raden av övertramp från Tyskland och andra EU-länder.

Även Rolf Englund deltog som åhörare och delade uppfattningen att pakten är död

- Men gör det något? Prodi och The Economist anser att pakten är "stupid" och dess

syfte var väl främst att få med det tyska folket och parlamentet på att överge D-Marken

för den kommmande Spagettivalutan, sade han på frågestunden, efter statsministern från Sverige och

Gunnar Örn från Dagens Industri.

Barry Eichengreen (University of California, Berkeley and CEPR) and Charles Wyplosz (Graduate Institute of International Studies, Geneva and CEPR) examine the rationale and likely effects of the Stability and Growth Pact in a chapter in new book, EMU: Prospects and Challenges for the Euro, published for CEPR (London), CES (Munich) and DELTA (Paris) by Blackwell Publishers.

They conclude that the Pact is unnecessary and fundamentally harmful.

http://www.cepr.org/press/EP26CWPR.htm

The Stability Pact: a collection of my articles

Charles Wyplosz

European Parliament COMMITTEE FOR ECONOMIC AND MONETARY AFFAIRS Briefing paper n° 3 – November 2004 Reform Proposals for the Stability and Growth Pact Jean-Paul Fitoussi

based on doctrinal arguments, the SGP favours the public good "public finances soundness", rather than the public good "macroeconomic stability" (i.e. reduction of length and amplitude of slowdown phases) which is at the basis of high growth and low unemployment.

”Stabilitetspaktens framtida tillämpning står och faller med hur tyskarna hanterar sin situation. Så länge Tyskland inte har ordning på sin finanspolitik har vi ingen fungerande stabilitetspakt.”

Det sa statsminister Göran Persson i samband med ett seminarium på tisdagen om stabilitetspaktens framtid, enligt Gunnar Örns referat.

Göran Persson var med vid toppmötet då stabilitetspakten klubbades igenom av Helmut Kohl och Theo Waigel, Tysklands dåvarande förbundskansler och finansminister:

”De insåg att den europeiska valutaunionen står och faller med finanspolitisk disciplin. Den bedömningen är lika riktig i dag.”

- Dilemmat, enligt Göran Persson, är att Tyskland har en konkurrenskraftig exportindustri i kombination med fallande inhemsk efterfrågan. Strukturella reformer får effekt först på några års sikt. Under tiden måste det bli finanspolitikens uppgift att hålla ekonomin i gång.

Kommentar av Rolf Englund: Hur skall det gå till när det hindras av stabilitetspakten. Se nedan om Brüning.

Top

Pakten har urvattnats så mycket att den inte längre fungerar, menar Lars Calmfors.

Lars Calmfors, What Remains of the Stability Pact and What Next?

SIEPS 2005:8

DN, Johan Schück, 8/11 2005

Det är inte första gången som Lars Calmfors är inne på liknande idéer. Inför det svenska avgörandet om euron förespråkade han att ett liknande finanspolitiskt råd skulle inrättas om Sverige kom med i EMU. Men det nya förslaget är mer omfattande, både när det gäller rådets tänkbara roll och genom att det riktar sig till alla EU-länder.

Läs utdrag här varför Calmfors tycker pakten är viktig och länk till hela rapporten

- Jag vet hur viktig stabilitetspakten är för mig som anhängare av en nationell finanspolitik men en europeisk penningpolitik. Det som ska förena eld och vatten där är stabilitetspakten.

Göran Persson i Europa-Posten nr 7/2002

EU's Prodi Calls Deficit Reduction Accord `Stupid'

2001

Monstruöst, sade Economist (om stabilitetspakten)

2001

EU:s ekonomiska stabiliseringspakt hotas av ett sammanbrott. Men den svenska regeringen och euroanhängarna vill inte debattera problemen av rädsla för att störa den kommande folkomröstningen.

Lars Calmfors DN Debatt 9/12 2002

Germany’s incoming “grand coalition” of Christian Democrats and Social Democrats is about to commit the biggest economic policy error since unification – the attempt to pursue budget consolidation at the expense of all other economic policy goals. In doing so, it risks turning a five-year-long stagnation into a full-scale depression.

It would be more accurate, perhaps, to compare her /Ms Merkel/ to Heinrich Brüning, a Christian conservative who was German chancellor from 1930 to 1932.

Wolfgang Munchau, Financial Times, 7/11 2005

Wolfgang Munchau is an associate editor of the Financial Times

Vad blev det kvar av stabilitetspakten?

Lars Calmfors och Anders Borg

SIEPS tisdagen den 8 november 2005, 9.00 - 11.30

Bra tillfälle att fråga Anders Borg om hans uttalanden:

»Mycket av det som många med mig trodde var välfärdsstatens kris på 1990-talet visade sig vara något som mer hängde ihop med felvärderad växelkurs och dålig makroregim än med grundläggande strukturfel.«

och "Verkligheten tvingar alla partier att anpassa sig. I vårt fall tror jag att den förändring vi nu är inne i försköts på grund av Carl Bildts starka ställning, hans enorma förtroende efter Bosnien gjorde att den här processen inte kom i gång så tidigt som den borde. Erfarenheten från de borgerliga regeringsåren – till exempel kronförsvaret – borde direkt efter misslyckandet ha värderats med mer kritiska ögon"

Klicka här

Germany’s incoming “grand coalition” of Christian Democrats and Social Democrats is about to commit the biggest economic policy error since unification – the attempt to pursue budget consolidation at the expense of all other economic policy goals. In doing so, it risks turning a five-year-long stagnation into a full-scale depression.

It would be more accurate, perhaps, to compare her /Ms Merkel/ to Heinrich Brüning, a Christian conservative who was German chancellor from 1930 to 1932.

Wolfgang Munchau, Financial Times, 7/11 2005

Wolfgang Munchau is an associate editor of the Financial Times

The leaders of Germany's government-in-waiting agreed on Monday night to make spending cuts worth at least €35bn by 2007 in order to bring the budget deficit back in line with the European Union's fiscal rules

Financial Times 25/10 2005

Stability Pact

How long can Germany play the "Reunification Card" as "exceptional conditions"?

What about France? What's its excuse? Is France undergoing reunification? Is France undergoing a shortage of brie?

Michael Shedlock 14/6 2005

How long can Germany play the "Reunification Card" as "exceptional conditions"? From now until doomsday? I mean really, how long can an exception last before it becomes the rule rather than the exception? What about France? What's its excuse? Is France undergoing reunification? Is France undergoing a shortage of brie? I admit the latter would be a total and complete travesty of justice but to the best of my knowledge, there is no brie shortage in France. How long can a country with no perceptible "exceptional conditions" get away with playing the "exceptional conditions" card? I have no doubt now that Portugal will somehow be claiming "exceptional conditions" quite soon. I can't wait to hear the excuse.

Meanwhile, some people are worried about the spread of SARS or the Bird Flu Virus. The real question to be answered is this: Is anyone paying attention to the rampant spread of "exceptional conditions"? Whatever strain of virus it is, it seems to be impervious to anti-viral efforts. Take a look a Germany. Wow! If the US ever catches that strain of the ECV (Exceptional Conditional Virus) we are in trouble.

The problem is that anyone who tells the truth would be fired or not reelected. People want to hear lies even when those lies do nothing but make problems worse. However, it now is readily clear that Issing and to a lesser extent Trichet, have both caught ECV. In light of that fact, I now confidently predict that the EU will soon be on the way to ZIRP (Zero Interest Rate Policy) next up after Japan.

Italy on Tuesday became the the first country to face disciplinary action under the European Union's revamped stability pact amid fears that public borrowing in the eurozone is getting out of control.

The European Commission wants to crack down on Italy's ballooning budget deficit to set an example to other countries and to prove that the eurozone can still maintain budgetary discipline.

Financial Times 8/7 2005

In spite of interest rates at historic lows, strong world demand, low inflation and healthy corporate profitability, the eurozone growth outlook is gloomy.

A stability trap?

"If the eurozone were no longer an area of stability, I think that some countries - particularly Germany - might say that a return to a national currency would create more stability."

Ralph Atkins FT May 27 2005

The ECB has acknowledged recent differences in growth rates between fast-growing countries such as Spain, and Germany and Italy, both of which have been in recession in recent quarters. But differences in fiscal deficits, trade balances and house prices are more striking, making harder the operation of a "one-size-fits-all" interest rate policy.

Joachim Fels, economist at Morgan Stanley, adds that the effects of a fiscal stimulus are dissipated in rigid economies such as those of the largest eurozone members. "If you don't have the flexible economy, much of the demand stimulus would spread into prices," he argues. His fear is that the long-run consequence would be eurozone "stagflation" - stagnant growth combined with higher inflation. "I'm not saying that would happen, but you would see such tendencies."

There is a risk that such pressures might even lead to the break-up of the eurozone, Mr Fels adds. "If the eurozone were no longer an area of stability, I think that some countries - particularly Germany - might say that a return to a national currency would create more stability."

Portugal admitted that its deficit could hit 6.8% of GDP in 2005.

Brussels said Italy had miscounted its budget figures in 2003 and 2004.

BBC 23/5 2005

The misleading inclusion of certain revenues brought Italy just within EU guidelines in those years;

in fact, according to the Commission's statistical office, it should have been just outside.

Hanteringen av stabilitetspakten visar också hur EU:s regler tillämpas olika för stora och små länder.

Det är svårt att förstå varför regeringarna i till exempel Danmark, Finland, Nederländerna, Sverige och Österrike inte utnyttjat sin vetorätt utan gett efter.

Lars Calmfors DN Debatt 3/4 2005

Stabilitetspakten har utgjort en grundpelare för det ekonomisk-politiska samarbetet inom EU. Pakten består av regler som syftar till att upprätthålla budgetdisciplin i medlemsländerna. De reformer som nyligen beslutats av EU:s finansministrar innebär emellertid att regelsystemet i praktiken sätts ur spel. Det finns därför skäl att analysera vad som hänt.

EU tycks ibland locka fram de sämsta sidorna i politiken: att frångå de principer man egentligen är överens om så fort det är politiskt opportunt. Hanteringen av stabilitetspakten visar också hur EU:s regler tillämpas olika för stora och små länder. Det är svårt att förstå varför regeringarna i till exempel Danmark, Finland, Nederländerna, Sverige och Österrike inte utnyttjat sin vetorätt utan gett efter.

Without the Stability Pact there would have been no support in Germany for the new currency.

The motto back then was: "The euro will be as strong as the deutsche mark."

The only thing that still matters to them is to somehow survive the next election.

None of the finance ministers and political leaders cares about the next generation and the common good of Europe.

Theo Waigel, Germany's finance minister from 1989 to 1998, Wall Street Journal 1/4 2005

Without the Stability Pact, though, there would have been no support in Germany for the new currency. The motto back then was: "The euro will be as strong as the deutsche mark." This statement was filled with real meaning when the criteria for joining the single currency were rigorously enforced in 1997 and 1998. Back then, all politicians from all parties together with all the major social organizations and institutions in Germany agreed on the stability course.

The German chancellor, meanwhile, simply accuses his critics of economic incompetence. That's some cheek coming from someone who presides over record unemployment and zero growth, and whose finance minister breaks all the promises he has made in the last few years.

- Jag vet hur viktig stabilitetspakten är för mig som anhängare av en nationell finanspolitik men en europeisk penningpolitik.

Det som ska förena eld och vatten där är stabilitetspakten.

Göran Persson i Europa-Posten nr 7/2002

Defanging the stability pact is not necessarily a bad thing

The Economist 22/3 2005

The one-size-fits-all interest rate of the unified currency has put stress on a number of European economies, including Germany’s.

Having given up the power of setting interest rates—and thus the ability to use monetary stimulus to help bring their country out of recession, many argue that governments in the euro area need more, not less, fiscal flexibility.

Fears about the outlook for German growth are likely to intensify after a survey showing business confidence in Europe's biggest economy tumbling unexpectedly for a second consecutive month.

FT 23/3 2005

The Munich-based Ifo institute said its business climate index had fallen from a revised 95.4 in February to 94.0 this month. Persistently high oil prices and the euro's strength were blamed by economists.

The survey comes as European Union leaders meet in Brussels to discuss measures to boost the EU's poor growth performance under the so-called Lisbon agenda.

Despite all its initial tough talk, the Stability and Growth Pact has delivered neither growth nor stability.

Will the new, relaxed version of the pact do a better job, or has it been reduced to the point of irrelevance?

Does it even matter?

BBC 23/3 2005

Nine years after it pushed the rest of the European Union into signing up to the pact, which threatened near automatic penalties against future eurozone countries running excessive budget deficits, Germany has led to victory a campaign to have its rules diluted.

The pact was a misguided solution to a non-existent problem

Financial Times Lex 22/3 2005

Welcome as it may be, the end rarely justifies the means. In purely economic terms, it is tempting to cheer the dismemberment of Europe's stability and growth pact.

The economies of western Europe remain a pretty diverse lot. They also lack many of the mechanisms to promote adjustment across the eurozone.

Labour and capital mobility are too small to be much help, while automatic payments from booming to depressed regions are virtually absent on a European level.

With devaluation no longer an option, that leaves national fiscal policies as the key tool to cope with divergent growth patterns.

All this suggests the pact was a misguided solution to a non-existent problem. Fears that irresponsible governments would drive up borrowing costs for the area always sounded like politically motivated scaremongering. After all, fiscal sinners would continue to be penalised by markets, given official assurances that the European Union or the European Central Bank will never finance a bail-out. The snag is that the haggling over the pact has made it much harder to believe those assurances.

Germany would be able to cite the costs of its reunification as an excuse for breaking the European Union’s stability and growth pact.

Since Germany spends 4 per cent of its GDP on transfers to the former communist east, the concession could help Gerhard Schröder to avoid further reprimands under the pact before next year’s general election.

Financial Times 21/3 2005

European Union finance ministers on Sunday night agreed on sweeping plans to rewrite the EU’s stability and growth pact, clearing the way for flexible new fiscal rules to be agreed at a summit on Tuesday.

Under a breakthrough compromise deal, Germany would be able to cite the costs of its reunification as an excuse for breaking the European Union’s stability and growth pact.

Berlin was said to be happy with the deal, which would allow EU members with deficits above the pact’s 3 per cent of GDP limit to cite the costs of “the reunification of Europe” as a mitigating factor.

Since Germany spends 4 per cent of its GDP on transfers to the former communist east, the concession could help Gerhard Schröder, German chancellor, to avoid further reprimands under the pact before next year’s general election.

Det finns ingen trovärdig vändpunkt i sikte. I dag står cirka 5,2 miljoner tyskar utan arbete.

Lärdomen från Tyskland är att det är helfel att slå sig till ro och hoppas på att den traditionella modellens exportindustri och stora socialsystem ska lösa problemet.

Problemet är att /den tyska/ regeringen har väntat och väntat med reformerna

PJ Anders Linder SvD 20/3 2005

Tyskland har nyligen genomfört reformer av arbetsmarknad och socialförsäkringar, som hade betraktats som politiskt omöjliga för bara några år sedan. A-kassan har fått en bortre parentes och arbetsförmedlingarna satsar mer på aktivt jobbsökande. Reglerna för anställningsskydd har blivit friare för de allra minsta företagen. Och i torsdags presenterade förbundskansler Gerhard Schröder fler reformförslag, bland annat sänkt företagsbeskattning.

Problemet är att regeringen har väntat och väntat med reformerna och genomfört dem först under galgen. Och det tar tid för strukturreformer att få genomslag, allra helst när de trots all sin laddning är begränsade i omfattning. Nu växer arbetslösheten trots liberaliseringarna och vill det sig riktigt illa hamnar den nya politiken i dålig dager innan den har fått chans att nå effekt.

Tysklands stora misstag är inte att en motvillig regering till sist tänkte nytt utan att man under så lång tid satt fast i tanken att samhälls- och välfärdsmodellen var färdig. Exportindustrins imponerande insatser bländade beslutsfattarna till den grad att de inte blev varse stelheterna och tillkortakommandena i tjänstesektorn och entreprenörskapet, och välfärdsåtagandena hade blivit heliga hos bägge de stora partierna.

De viktigaste artiklarna om Stabilitetspakten

Jean-Claude Trichet, president of the European Central Bank, called on member nations to uphold rules enforcing fiscal discipline, warning that the stability of the euro and the bloc's economy are at stake.

His comments before the European Parliament in Brussels come just days before this weekend's meeting of EU finance ministers trying to overhaul the tattered Stability and Growth Pact.

Wall Street Journal 15/3 2005

Meanwhile, European Commission President Jose Manuel Barroso said he would defend a contentious plan to deregulate services by allowing service providers such as lawyers, construction workers or doctors to work outside their home countries anywhere in the EU.

Standard and Poor's, the credit rating agency, last week published a report in which it warned that a further relaxation of the /stability/ pact would undermine bond ratings in the long run

Wolfgang Munchau, Financial Times 14/3 2005

Financial markets have been too optimistic about the long-term fiscal sustainability of some of the eurozone's member states. They never attached much credibility to the "no bail-out" clause - under which the ECB is prohibited from taking on the debt of countries in financial distress - even though it is explicitly established in European law and the ECB's founding charter. The markets assumed that problems, were they to arise, would be shared among all participants. In particular, the markets thought that no country would default on its outstanding debt.

Investors are best advised to treat the debate over "reform" of the stability pact for what it is: a charade to let governments off the hook. Instead, they should take a hard look at the long-term sustainability of public finances in each eurozone member, taking account of the deficit, the net debt and other long-term obligations such as pensions. On this account, it is difficult to justify some of the present bond valuations.

Moving the Goalposts: How Reform of the Stability and Growth Pact Could Undermine Eurozone Sovereign Ratings

Top

European firms are becoming more and more voluble about the damage the weak dollar, and strong euro, is doing to their profits.

French defence contractor Thales became the latest to warn of lower sales and profits.

The euro has gained more than 50% over the past three years.

BBC 11/3 2005

Its comments come a day after luxury goods firm LVMH and Volkswagen both said the euro's surge against the dollar was hurting their plans.

On Friday morning, one euro was worth $1.34, not far below late December's all-time high of $1.3637.

There is a growing risk that the European Union will be left either with an unreformed pact no one honours

or a reformed pact so riddled with exemptions as to be in practice worthless.

Primary responsibility for the failure to reach agreement lies with Germany, which insists that unification transfers and EU contributions be exempted from the 3 per cent deficit ceiling.

Financial Times editorial 10/3 2005

A poll of 70 of the largest US employers in Germany found that a third of these companies planned to cut their workforce and pull production capacity out

Financial Times 8/3 2005

High costs and a rigid labour market are driving US manufacturers away from Germany in spite of the government's efforts to attract foreign investment, according to a survey published on Tuesday.

A poll of 70 of the largest US employers in Germany, including such blue chip brands as Coca-Cola, Ford, Wal-Mart and Procter & Gamble, found that a third of these companies planned to cut their workforce and pull production capacity out of the country this year.

The survey, conducted by the Boston Consulting Group on behalf of the American Chamber of Commerce in Germany, which was due to be presented to the German parliament on Tuesday evening, is a blow to Chancellor Gerhard Schröder's government, which has pushed through an unprecedented string of economic reforms in the past two years.

Friday's jobs and wage deal between General Motors and its German employees is a good example of what is happening in the German economy right now.

Employees agreed to nominal wage cuts and more working time flexibility. They will also forego pay increases until 2010 in some cases.

Wolfgang Munchau FT 7/3 2005

There are two reasons why German workers accept such deals. One is that unemployment has gone up. On a cyclically adjusted basis, the rate of unemployment now stands at 9.3 per cent of the working population, which is exactly two percentage points above the average rate in 2000, at the high point of the last economic cycle.

The second reason is that the labour market reforms of Gerhard Schröder, the chancellor, are beginning to work. Unemployment has not only become more probable. Welfare reform has also made it less attractive, especially for the long-term unemployed.

The critical question is: are we observing a one-off shift in real wages? Or is this going to be a drawn-out process that will depress consumption for the foreseeable future?

The bad news is that there are no signs that wage moderation is ending. Workers at Opel will be facing declining real incomes for the rest of this decade. The country's nominal wages are not yet falling, but last year they came close. The rise in per capita nominal wage costs - which had grown at annual rates of between 1 and 2 per cent during 1996 and 2003 - fell to zero per cent in 2004. As the Opel case suggests, there is much greater nominal wage flexibility in the German economy than is widely believed.

If the Opel pay deal catches on, a deflationary spiral could develop. As employees expect to earn less money in the future in real terms, they reduce their consumption patterns accordingly. This in turn could lead to lower investment, resulting in more wage moderation, a contracting economy and so on.

The appropriate policy response is for the central bank to remain open-minded. The German government should consider whether to increase public sector investment by a sum equal to 1 or 2 per cent of gross domestic product. Both education and transportation infrastructure have suffered from underinvestment in recent years.

Unfortunately, the policy response is going to be different. The European Central Bank said the next interest move would be upwards. The German debate on reforms focuses again on the labour market. Furthermore, the stability pact, the fiscal rules underpinning the euro, discourages large-scale investment programmes by any eurozone country.

In the absence of an appropriate policy response, it is more difficult than it should be to predict whether the German economy can escape the low-growth trap.

Few have realised the most dangerous feature of EMU:

it has locked Germany into a seriously uncompetitive real exchange rate

Martin Wolf, Financial Times, March 31, 1999

Germany has two histories: one that takes up most of the first half of the 20th century and one before 1900 and after 1945.

In the fourth century, German warriors controlled virtually every senior military post in the Roman army and ran the Roman empire in its last decades.

Steven Ozment Financial Times 4/3 2005

The writer is a professor of history at Harvard University and author of A Mighty Fortress: A New History of the German People (HarperCollins/Granta Books)

One problem is the "German disease" of a chronically stagnant economy. The combination of a 35-hour week, six weeks of annual leave, retirement at 55, social spending at 30 per cent of gross domestic product - all amid the world's highest wages and taxes - suggest self-indulgence unbefitting the world's third largest economy.

The numbers are not good: Germany has suffered four consecutive years of stagnation, 10 per cent unemployment and a continued lack of investment. But the straws in the wind are encouraging. Germany still accounts for a third of the European Union economy. Its business has learnt the art of the hostile takeover and how to downsize a company. Threatening outsourcing, industries bargain harder and unions agree to longer working weeks without increased compensation.

A second problem is the integration of Germany's 7.3m foreign residents, half of whom are Muslim and 70 per cent of those Turkish. The numbers are startling and some observers worry that secular Germans will find themselves at odds with devout Muslims who honour Islamic law over German constitutional law.

In the fourth century, German warriors controlled virtually every senior military post in the Roman army and ran the Roman empire in its last decades.

Who, in 1945, would have believed that a European Union with German wealth would be integrating eastern and western Europe at the turn of the century, or that Germany's foreign minister would be the champion of Turkey's admission into that Union? Today's pundits and political advisers who tell world leaders to count the Germans out only prepare them for unexpected surprises.

Riksbankschefen Lars Heikensten går till hårt angrepp mot EU-ländernas stabilitetspakt i en debattartikel i Financial Times.

"När pakten tvingar regeringar till smärtsamma konsolideringar som borde ha genomförts i goda tider - just när länderna är på väg att ta sig ur en recession - urholkas paktens trovärdighet", skriver han i artikeln.

DI 2/3 2005

The lack of action in prosperous times makes the pact pro-cyclical, causing it to amplify economic fluctuations. When the pact forces governments into painful consolidations that should have been implemented during booms- just when they are trying to drag their economies out of recession - its credibility is eroded.

What has been forgotten is that a well-balanced fiscal policy is not just necessary for the monetary union as a whole but is in the interests of the individual countries themselves.

Countries should embrace stability targets By Lars Heikensten Published: March 1 2005 20:25 click

Överskottsmålet - Buffertfonder - EMU-skatten

German unemployment shot up to 5.2m last month, its highest level in 73 years, dragging Europe's largest economy deeper into its most serious political crisis in months.

Concern is now rising in the party that Berlin's apparent failure to tackle endemic unemployment could earn the SPD another electoral setback in North Rhine-Westphalia. Germany's most populous state, and an SPD stronghold, goes to the polls on May 22.

FT 1/3 2005

European Sado-Monetarism

"What could Europe do to protect itself in the face of a narrowing US deficit. The obvious answer would be to stimulate domestic demand by cutting interest rates and taxes. But...

Anatole Kaletsky of GaveKal research Cit by John Mauldin 25/2 2005

Förra året steg arbetslösheten i Portugal till 6,7 procent, lägre än EU-genomsnittet men bruttonationalprodukten växer knappast alls.

I och med euron kan vi inte heller längre snabbt lösa problemen för dagen med att ändra räntan eller valutan, säger doktor Teodora Cardoso, chefsekonom vid Banco Portugal.

Ekot 17/2 2005

Officiellt är arbetslösheten lägre än i många andra EU-länder men många portugiser misstänker att siffrorna är justerade och tycker att regeringen måste göra något åt den ineffektiva statsapparaten.

Stabilitetspakten på väg att bli svagare

Det råder enighet om att pakten inte har fungerat. Flertalet länder har inte "samlat i ladorna" tillräckligt under goda tider. Därför har många länder flera år i rad brutit mot underskottsförbudet. Tyskland och Frankrike är de grövsta syndarna.

Mats Hallgren 16/2 2005

Ett preliminärt förslag till reformer av EU:s stabilitetspakt ligger på bordet när de tolv euroländernas finansministrar träffas i Bryssel i kväll. Förslaget skulle leda till en försvagning av den överstatliga EU-kommissionens väktarroll och en uppluckring av paktens bindande "straffprocedur". Samtidigt skulle EU-länderna frivilligt åta sig att stärka sina offentliga finanser i goda tider och anstränga sig mer för att betala av på sina statsskulder.

Full text med saklig info som vanligt med Mats Hallgren

There’s only one thing worse than blatantly disregarding this pact, as the Germans and French have repeatedly done almost since inception; that’s adhering to it.

The Euroland economies, therefore, risk finding themselves in a situation not unlike that of Argentina in the autumn of 2001: no policy tools readily at hand to deal with the problem of declining aggregate demand

Marshall Auerback 25/1 2005

There is also a supreme irony (not to say, schadenfreude) that the pact’s major offender is also its architect: in the planning phase of European Monetary Union, Germany was concerned that its long-term record of low inflation might be put at risk by Italian fiscal profligacy in a currency union. It was Germany, therefore, that drafted and imposed the stability and growth pact on all future eurozone participants.

Of course, it is very easy to talk about controlling national profligacy and exporting Germany’s “stability culture” to the rest of Europe during a period of solid growth, particularly when the author of such demands is the economic powerhouse of the continent (as was the case for Germany throughout much of the post World War II period, especially when the Stability Pact was being designed). Governments can easily retain balanced budgets in good times without unduly cutting spending on popular programs, given higher tax receipts and lower attendant social security costs.

But when an economy weakens, invariably income tax receipts decline, social welfare expenditures increase and budgets tend naturally toward deficit. In that context, a pact that puts too much weight on achieving fiscal savings in this kind of environment can risk exacerbating an economic downturn. The fact that fiscal policy may not be able to counteract short-term fluctuations in the simplistic neo-Keynesian manner advocated by policy makers in the 1960s does not mean that the fiscal stance should not be relaxed at all if aggregate demand is slumping badly, particularly if such slowing is caused by an increase in net private sector saving in response to a macroeconomic shock.

The 3 per cent limit itself is arbitrary. No good reason has been advanced for this figure, rather than, say, 2 per cent or 4 per cent, and it fails to address the issue of what governments ought to do if and when the private sector is clearly in retrenchment and no longer able to generate sufficient investment to underpin growth and employment.

Att det skulle bli så här var inte svårt att förstå:

EMU är fast växelkurs in absurdum. Om det går illa

för Tyskland, vilket det nu gör, kan Tyskland inte ändra sin

växelkurs, den ligger fast för alltid, eller åtminstone till

EMU kraschar, vilket det kommer att göra. Det kommer att ske när

dollarn faller och Europa drabbas av massarbetslöshet. Och så

är det den förfärliga Stabilitetspakten. Den bygger på den

i grunden felaktiga tanken att när det blir dåliga tider och statens

skatteinkomster sjunker och utgifterna för arbetslösheten ökar,

då skall staten skära ner på sina utgifter eller höja

skatterna. Det är dårskap.

Rolf Englund i

EU-krönika i NWT 2001-08-10

Because euro members have shed their power to pursue independent monetary and exchange-rate policies, they need more fiscal independence, not less.

The Economist 20/1 2005

What connects claims of unfair tax competition to rows over the stability pact is the notion that it is right for Brussels to interfere in national governments' decisions on taxes and spending. Yet this is a bad idea, on both political and economic grounds. Fiscal policy lies at the heart of democratic electoral politics, which is conducted at the level of nation-states. If an elected government wishes to cut taxes, boost spending or even run a bigger budget deficit, it is a travesty of democracy if the European Commission stops it.

Some argue that central rules are needed on economic grounds, to underpin the euro or to stop a race to the bottom in taxes. Actually, the opposite is true. Because euro members have shed their power to pursue independent monetary and exchange-rate policies, they need more fiscal independence, not less.

What, finally, about the worry that inspired the stability pact in the first place: the need to stop profligate euro members running up big deficits at others' expense? financial markets are quite able to exert discipline, even over euro members: witness the credit downgrade suffered by Italy last year. The only rule that is essential is a reaffirmation that neither the European Central Bank nor any other EU body will stand behind a national government's debt—so that if it gets into trouble, the pain will be felt at home, not abroad.

Stabilitets- och tillväxtpakten är död, men inte begraven.

I Europa råder ett oklart tillstånd, där gällande regler för EU-ländernas offentliga finanser inte åtföljs. I verkligheten gäller den starkes rätt, där de större länderna kan ta sig rättigheter som inte gäller för de mindre.

Johan Schück DN Ekonomi 22/1 2005Läs mer här

At no time were the countries of the European Union economically prepared to adopt a single European currency.

Yet political expediency accompanied by jealous anti-Americanism led 12 European countries to surrender national monetary policy without the necessary ingredients in place for an optimal currency area, especially labour mobility and fiscal equalisation.

Ironically, in the planning phase of this exercise Germany was concerned that its long-term record of low inflation might be put at risk by Italian fiscal profligacy in a currency union. It was Germany, therefore, that drafted and imposed the stability and growth pact on all future eurozone participants.

Uwe Bott, President, Cross-Border Finance, New York, Letters FT 20/1 2005

In adopting the pact, the eurozone governments then agreed additionally to yield fiscal policy, the only remaining instrument available to countries to ride out economic cycles within their borders. Consequently, electorates in many European slow-growth nations have become increasingly disenchanted with their governments, while national governments have grown increasingly helpless to counteract economic distress against a background of non-intervention at European government level. It goes without saying that all the whining about policy impotence is a mere deflection from Europe's unwillingness to adopt the necessary structural changes in order to become prosperous again. Still, the chancellor's proposal may be the first sign of an unravelling of the underlying fundamentals of the euro.

Gerhard Schröder has called for a loosening of the European Union's fiscal rules

In an article in Monday's Financial Times, Mr Schröder argues in favour of substantial exemptions to the EU stability pact that would also severely restrict the European Commission's latitude to intervene in the fiscal affairs of member states.

FT 16/1 2005

Gerhard Schröder, the German chancellor, has called for a loosening of the European Union's fiscal rules, an alteration that would allow Germany and other countries to run significant budget deficits. In an article in Monday's Financial Times, Mr Schröder argues in favour of substantial exemptions to the EU stability pact that would also severely restrict the European Commission's latitude to intervene in the fiscal affairs of member states. "The stability pact will work better if intervention by European institutions in the budgetary sovereignty of national parliaments is only permitted under very limited conditions," writes Mr Schröder. "Only if their competences are respected will the member states be willing to align their policies more consistently with the economic goals of the EU."

The article is the first concrete initiative by Mr Schröder in the debate about stability pact reforms, due to be agreed at the March EU economic summit in Brussels

A framework for a stable Europe

Reform of the European stability and growth pact is a key issue in European economic and financial affairs.

Gerhard Schröder FT 17/12005

Reform of the "excessive deficit procedure" will be the cornerstone. Strategies for reform must reflect the fact that it is not just a stability pact, but also a growth pact. Whether a fiscal policy is "right" and promotes stability and growth equally cannot be measured solely by compliance with the deficit reference value of 3 per cent of gross domestic product.

Macroeconomic criteria form a second group. Member states must be given sufficient leeway to provide cyclical incentives. At present a deficit of more than 3 per cent is only tolerated during a severe economic downturn. However, in the past few years we have experienced stagnation rather than anything worse. The mechanistic application of the pact has led the EU to recommend further restrictive measures, which have delayed recovery and thus put at risk long-term consolidation.

- Jag vet hur viktig stabilitetspakten är

för mig som anhängare av en nationell finanspolitik men en europeisk

penningpolitik.

Det som ska förena eld och vatten det

är stabilitetspakten

EMU-beslutet

större än EU-beslutet

Göran Persson i Europa-Posten nr

7/2002

The summit will also hope to agree reforms to the EU's stability and growth pact

FT 10/1 2005

Hans Eichel, finance minister, criticised the Bundesbank for refusing to help ease government financial problems by selling gold reserves.

Financial Times 21/12 2004

Mr Eichel told the Financial Times that the central bank's decision on Monday to sell only eight tonnes of gold in the next nine months was "very difficult to explain". Under an accord among 15 European central banks, the Bundesbank could have sold 120 tonnes by September 2005, a sale that would have brought government revenues of about €1bn, according to Mr Eichel.

Can the European Stability Pact survive?

The European Commission is giving up on its attempts to hold France and Germany to account for repeatedly breaching the financial rules

BBC 14/12 2004

France and Germany have been in breach of that limit since 2002. To some, the Commission's decision not to impose sanctions on the EU's two biggest economies is a sign that Brussels is admitting that the Pact is well and truly finished, ending the first chapter in the Commission's attempts to co-ordinate national economic policies across the European Union.

No-one wants to see eurozone countries start racking up large deficits as that would raise the cost of borrowing for all countries involved.

Weak demand in the eurozone baffles economists

Gross domestic product rose by just 0.3 per cent in the three months to September compared with the previous three months, as export growth slowed and household spending remained flat.

Financial Times 8/12 2004

There is even talk of recession. Joachim Fels, economist at Morgan Stanley, expects growth of 0.2 per cent in the first three months of 2005. "I would argue that the eurozone is flirting with recession," he says. "I would put the chances of a short recession in the first half of next year at about 40 per cent." The ECB now expects growth of about 1.9 per cent next year, little better than in 2004.

Michael Dicks, economist at Lehman Brothers, says that traditional economic models for forecasting consumer behaviour have broken down: they no longer explain why so much is being saved rather than spent. His explanation is that the eurozone - especially Germany - is suffering the short-term side effects of the push towards structural reforms by governments and restructuring by companies, both with the aim of boosting longer term labour flexibility and international competitiveness. Mr Dicks warns that the increase in "precautionary savings" by eurozone consumers "might become a permanent phenomenon if the authorities are seen reneging on the social contract and no longer deliver the sort of services that people have come to expect from the welfare state".

At the ECB, Mr Trichet's dilemma is twofold. First, his job is not, primarily, to boost growth in the eurozone or to help eurozone exporters. The mandate inherited from the Bundesbank, the German central bank on which the ECB is modelled, makes ensuring price stability its main task - although he can argue that price stability creates conditions for growth.

Second, it is far from clear that the ECB's governing council would accept that the euro's strength is a significant factor in the eurozone's malaise and that therefore a cut in interest rates was justified.

The Euro Homepage by Giancarlo Corsetti

Grekland har presenterat för låga, felaktiga uppgifter om storleken på de grekiska budgetunderskotten de senaste åren

Ekot 22/9 2004

I själva verket har de grekiska budgetunderskotten varit så stora att landet i praktiken brutit mot reglerna i den så kallade stabilitetspakten flera år i rad.

De nya, korrekta siffror som nu presenteras visar att Grekland kanske inte ens uppfyllde de ekonomiska kraven som ställdes för att klara inträdesvillkoren för att bli medlem av den gemensamma valutan euron 2001.

Vad värre är: 2000, det vill säga året innan grekerna släpptes in i det gemensamma valutasamarbetet var budgetunderskottet 4,1 procent istället för 2 procent som grekerna uppgivit. Det visar att Grekland blev medlem av den gemensamma valutan utan att ha klarat inträdeskraven.

Trichet warns against loosening of stability pact

Financial Times 22/9 2004

Jean-Claude Trichet, president of the European Central Bank, warned on Wednesday that any loosening of the European Union's rules on budgetary discipline would be “dangerous”.

Mr Trichet rejected in the strongest terms yet proposals by the European Commission to relax the stability and growth pact's rules on excessive budget deficits.